3 Key Insights From Metrolinx’ Latest Report

Metrolinx released their latest report: “Context Paper on the Regional Economy, Demographic Outlook and Land Use”. Long boring title, but some very interesting charts and stats inside for real estate investors. Find out 3 key insights on population trends in the Greater Toronto Area that will help you as you plan your real estate portfolio in the next 5 years.

Click Here for Episode Transcript

| Andrew la Fleur: | Find out what Metrolinx latest report has to say about population trends in the GTA on today’s episode.

|

| Speaker 2: | Welcome to the True Condos podcast with Andrew la Fleur, the place to get the truth on the Toronto Condo market and condo investing in Toronto.

|

| Andrew la Fleur: | Welcome back to the show. Thank you for listening in once again. As I said in the intro, I’m going to be talking today about the latest report from Metrolinx. I want to give a shout out to Igor Dragovich for sending this one over to me via Twitter and calling it to my attention. Some interesting back and forth chatter going on on Twitter this week about this report. It actually came out a few weeks back but I’m just noticing it now. Certainly whenever you’re a real estate investor or you’re interested in getting into real estate investing, one of the key areas you need to school yourself on is economics and understanding the trends that are happening in the area that you’re looking to invest. Of course we’re looking at the Toronto condo market here on this podcast.

|

| We want to look specifically at what Metrolinx has to say about Toronto and about growth trends and other things. I have three key insights that I want to pull for you today from this very lengthy report. I will include, of course, a show link to the report in the show notes for this episode. You can get the show notes for this episode, and all the episodes of this podcast, by just heading on over to truecondos.com/podcast.

|

|

| For those of you who don’t know, Metrolinx, again. is a regional transportation authority. The paper that I’m talking about is called, bear with me on the name, it’s the context paper on the regional economy, demographic outlook and land use. Very boring name, but basically it has a lot of very interesting stats and tidbits and information using the latest stats that we now have, all the way up to the 2016 census. It’s very interesting to see, now that the 2016 census data’s available for a lot of this stuff, what the numbers are looking like from the last five years of the latest census.

|

|

| From the executive summary, some interesting tidbits here. For many years in the Greater Golden Horseshoe, in the Greater Toronto Hamilton Area in particular, has been one of the fastest growing urban regions in North America. This growth is strongly influenced by migration patterns. That’s the very first thing they put in their executive summary of the report, and again a very good reminder for all of us as condo investors. Why are we investing in Toronto at all? Why is this such a great area to invest in? Because it is one of the fastest growing urban regions in North America. Again, it’s something we talk about over and over and over but very important to remember, especially if you’re new to condo investing or getting into it for the first time this year. Key point to remember is this is a growing area. Whenever you have growth, that’s a good place to invest, as a general rule of thumb.

|

|

| Next point they talk about is historically, over the last ten years, the GTHA, the Greater Toronto Hamilton Area, has experienced lower than the historical average net migration rates, largely due to the pull of Western Canada and the oil boom. Migration to the GTHA is expected to return to historical average rates as a result of an improving Ontario economy driven by a lower Canadian dollar and the growth of the US economy. Very interesting point there.

|

|

| Again, historically there’s been a lot of growth in the Greater Toronto Area, in the Greater Golden Horseshoe Area. A lot of growth as has been here for many, many, many years, but over the last ten years we’ve experienced lower growth as Alberta and the whole oil boom has sucked a lot of the growth that otherwise would occur here. A lot of jobs and things have been going West. Now, of course, that trend has been reversed. A lot of that money and people and jobs are coming back to Ontario. Again, we talked about this a lot in the past in the podcast, that long-term, if you’re thinking in twenty-five year chucks, where is the best place to invest? It’s always going to be in Toronto, in my opinion. In the Toronto area, as the center of Canada, is the center of our economy. It is the largest city, obviously, in Canada. Yes, there will be waves where Alberta or other area perhaps might emerge as higher growth areas, but in the long run Toronto is always going to be the best.

|

|

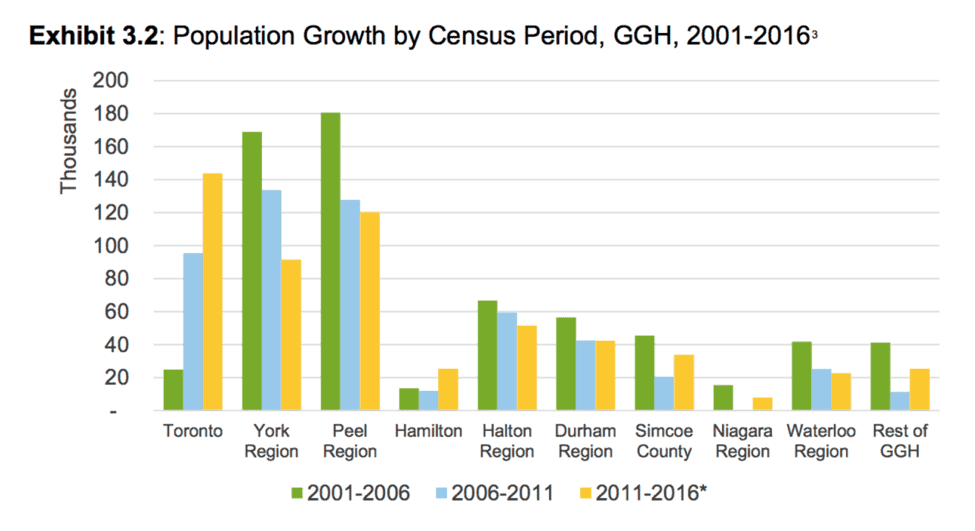

| There’s a couple, just the tidbits right off the top. Now, three insights I wanted to bring to you. The first one is that Toronto population growth, growth of population in the city of Toronto is accelerating, while growth in the 905 regions is actually decelerating. Very interesting when you look at the numbers from that perspective. I’ll include some of these charts, a few of these chart I’ll include on the show notes for this episode.

|

|

| The first point here, if you look at the growth, and they break it up into the last three census periods from 2001 to 2006, from 2006 to 2001, the second one, and the third one, the most recent one, 2011 to 2016. Again, the census period is every five years. You notice a very interesting trend that Toronto population growth is accelerating. Yes, it’s huge but it’s also gaining speed. If you look at, and then conversely you’re looking at the 905, particularly the York region and Peel region, their growth is actually decelerating. Very interesting. Toronto and the 905, in that sense, are going in opposite directions in terms of population growth. Now, that’s not to say that the 905 is not still growing. It is still growing. It’s growing at a very healthy rate, very big numbers still, but not as much as it was growing before. Again, tying into last week’s episode of investing in the core of Toronto, the downtown core. More and more evidence to suggest that, moving forward, that is where we’re going to see the most amount of growth and that’s where you want to have most of your portfolio as a real estate investor, is in the core of Toronto.

|

|

| You look at Toronto, for example, numbers-wise about twenty-five thousand was the growth number in the first census period fifteen years ago. Up to today, that number has jumped multiples, up to about a hundred and forty-five thousand versus York region, Peel region, their numbers were respectively one seventy and one eighty, much higher than it is in Toronto today but that was in 2001 to 2006 period. Now, in the latest census period, those numbers have fallen dramatically from one seventy in York region down to ninety thousand and in Peel region, from one eighty down to a hundred and twenty thousand. Not as dramatic but still a significant drop. Again, it’s a little bit easier when you see the chart on this on the show notes for this episode. Check out the chart that I’m talking about. Point being, Toronto moving in one direction up, accelerating population growth and the 905 regions still growing and still growing at a very healthy rate but that growth is decelerating. There are many factors. I might be going into that. Just again, the point to be made, that more and more people are moving into the core or are moving closer to where they work. Certainly the condo boom, in the downtown core, has a lot to say about that as well. That’s the first point. Very interesting thing I noticed.

|

|

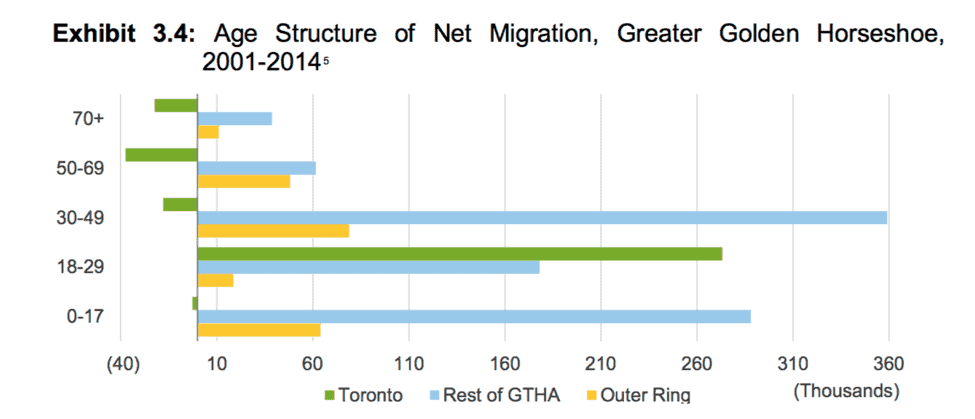

| The second point I want to point out, a key insight that I took from this Metrolinx report, is that where is this growth coming from? I noticed that the growth in Toronto, in the city of Toronto, again focusing on Toronto, growth in Toronto is driven primarily by millennials. Millennials are really driving this growth in Toronto. If you look, again I’ll put a chart up, there’s a great chart that shows the net migration from 2001 to 2014 by age. It clearly shows that the eighteen to twenty-nine year old bracket, which is the millennial generation that everyone’s big on, it’s the biggest cohort that’s out there, the most influential one for economics and housing and everything else it seems. They are, by far, moving to Toronto versus moving anywhere else in the GTA.

|

|

| Again, the growth in Toronto is really being driven by this millennial cohort, and of course, as condo investors, we love to see that. We love to hear that because who are the key condo buyers and condo renters of the next five years, who are buying and renting from us as investors who are making decisions today and taking action today? Of course it is the millennials. We love to see that they are coming into Toronto in drove and they are not coming into the rest of the GTA even nearly as much as they are into Toronto. That’s good to see. Not exactly surprising. We do expect that. It has been historically the case where people in that age group will tend to move to Toronto and they will tend to move out of Toronto as they have kids and as they have families and their housing needs continue to expand.

|

|

| Again, something we talked a lot about on this podcast is the fact that a lot of them will want to stay. As commuting times are becoming worse and worse, we talked a lot about it on last week’s episode, a lot of these people will want to stay, as family sizes are becoming smaller and smaller, as people are getting married later and later. All these trends are indicating that the millennials who are moving here today will be the thirty somethings and forty somethings that will want to stay in the city tomorrow. That’s the second point.

|

|

| The third insight that I pulled and I want to share with you from this Metrolinx report is that Toronto, this is very interesting I thought, it was buried in the report here but is a very important point I think for us to take note of, that Toronto has outperformed expectations from a population growth standpoint. When you look at all these official government agencies projecting out populations and demographic and so on, for planning purposes and transit and housing and roads and infrastructure and everything else, they have their certain expectations and growth that they are planning for. They’re doing their five, ten, twenty-five year plans. Toronto has outperformed those expectations. From the report, listen to this. Since 2011, Toronto has attracted a greater share of new population and employment than had been forecast in 2006 for the growth plan. At the same time, growth in the rest of the Greater Toronto Hamilton Area and the Greater Golden Horseshoe has generally been lower than forecast. Very interesting. Basically the writer of the report is basically pointing out, look guys it kind of caught us by surprise, this growth in Toronto. We knew it was going to grow but it’s actually grown a lot more than we expected. Conversely, the 905, has not grown as much as we have expected.

|

|

| Overall, the whole region, is pretty much on track they’re saying, to what they had been planning for over the long-term, especially since the Alberta economy has really slowed down. A lot of that migration that we were losing to Alberta has now come back, so that sort of cancelled itself out. What’s interesting, again, is that Toronto has really outperformed and the 905 has under-performed population growth. Very interesting trend to continue to watch that. Again, another reason why I believe that you want to continue to have most of your investment portfolio, over time, in the downtown core of Toronto. That’s where you’re going to see the most growth. That’s where you’re going to have the easiest time renting units. That’s where you’re always going to have demand for reselling and for renting units in the future. It’s really becoming a no-brainer from a growth perspective. If you look at what’s happening in the whole region, it’s downtown, downtown, downtown, is where you want to be.

|

|

| Again, not to say that you should never invest outside the downtown, that there are not exceptions to that rule, but that is the general rule of thumb that I am telling all my clients to follow and that I am following, of course, myself as I’m building my own condo investment portfolio over time. The vast majority of my units are in the downtown core.

|

|

| There you have it. There’s my three key insights. Number one, Toronto population growth is accelerating, while the 905 region population growth is decelerating. Number two, growth in Toronto is driven mostly by millennials. Number three, Toronto has outperformed expectations of population growth, while the 905 and the rest of the Greater Golden Horseshoe has under-performed expectations over the last five years.

|

|

| There you have it. That is today’s podcast. I hope you enjoyed this episode. Once again, if you like the show, I’d be very grateful if you would leave a review or share this episode, send it to somebody you know who might find it interesting. Of course, make sure you do subscribe to the podcast on iTunes or on Stitcher or whatever device you’re listening it to. A lot of people just … There’s push/play on my website truecondos.com and listen to the podcast there, which is fine, which is great. I love it. Not going to tell you not to do that. Again, the best listening experience and most control and getting the episodes as soon as they’re released, the best way to do that is by subscribing on your phone, on your ipad, on your device that you’re using, through iTunes or through Stitcher. If you have any questions about how to do that you can always send me an email or you can Google, of course, too. It’s not that hard but I’m here to help if you need any help with that. You can always reach me, andrew@truecondos.com. Call, text 416-371-2333. Until next time. Have a great week.

|

|

| Speaker 2: | Thanks for listening to the True Condos podcast. Remember, your positive reviews make a big difference to the show. To learn more about condo investing, become a True Condo subscriber by visiting truecondos.com.

|