Should Your Parents Sell Their House and Buy a Condo?

Are your parents at retirement age and wondering if now is the time to sell their home and buy a condo? You’re not alone – this is a very common question. In this episode, Andrew la Fleur looks at the many potential reasons why people think it’s a good idea to sell their home and buy a condo, he will identify the one single reason that underlies them all, and he presents 2 alternative solutions to the question of should your parents (or you) sell their house and buy a condo?

EPISODE HIGHLIGHTS

1:40 Downsizing/Rightsizing.

5:00 What if’s.

6:37 Biggest thing I want to address in this episode.

7:14 Why are you feeling the urge to sell your house and to buy a condo?

8:45 Potential ways that you can get that cash flow and address that problem.

9:50 Should Your Parents Sell Their House and Buy a Condo?

13:20 Think about using your home equity to solve your cash flow problem.

21:22 Good aspects of this solution.

22:31 Rent a condo but keep your house.

26:19 Keep your capital in a single family home if you can.

27:45 Condo-ize your house.

Click Here for Episode Transcript

Andrew la Fleur: Should your parents sell their house and buy a condo? Find out on today’s episode.

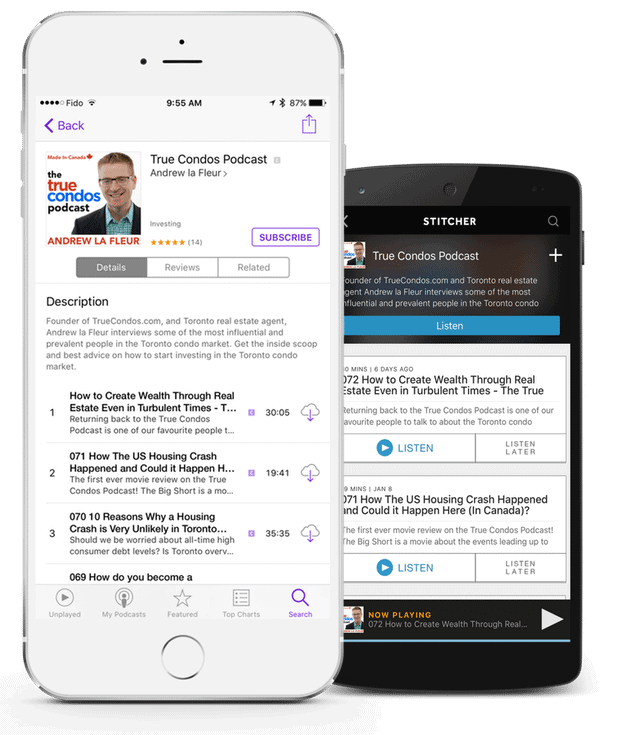

Speaker 2: Welcome to the True Condos Podcast with Andrew la Fleur, the place to get the truth on the Toronto condo market and condo investing in Toronto.

Andrew la Fleur: Hi and welcome back to the show. Thanks for listening. On today’s episode, we’re going to talk about a popular question that might come up every time that you’re at a family gathering of any type. Depending on when you’re listening to this episode, you might have been coming out of a number of family gatherings because it is early January at time of recording 2017, and a lot of people are just getting back into the swing of things, myself included, after an extended Christmas, New Years holiday break. At those times, you’re often in various meals and parties and settings with your family. I don’t know about you, but if you’re like me then a popular topic around the dinner table is always real estate. With respect to the older generation and aging parents and this sort of thing the question is often, “What are we going to do? Is it time to downsize? Is it time to sell the house and buy a condo?” I wanted to give some thoughts on that subject to you here today.

First of all, I want to look at why this is often something that comes up. Why would it be that somebody might be thinking about selling their house and buying a condo instead? I think the number one thing is, as I mentioned, down sizing or as some people are now calling it right sizing, whatever that means. Down sizing, right sizing, just feeling the need to have a smaller space, not needing as much space anymore. The kids have moved out. They moved on. They have families of their own, that sort of thing. Another popular reason, you’re sick of house maintenance or responsibilities of owning a house, owning a property. Obviously owning a condo is much less responsibility than owning a house. Too much space or overwhelmed, overwhelming is a common adjective I hear a lot of people talking about, just being overwhelmed with the amount of space that was once filled with people and kids and now is empty and is just sort of a sense of overwhelm at having to manage and live in and take care of more space than you need.

How about you want to travel more, lifestyle choices. You just want to have more freedom and flexibility that would come seemingly with owning a condo versus owning a house. Not having to think about the house or the property as you are traveling around and doing more things in your retirement years. A big one is cashing out. This idea of, “Is it time to cash out of the property?” That’s a common phrase that I hear is you’ve got all this money sitting in there and you want to cash it out, like a cha-ching, there goes the register. Time to cash in your biggest chips so to speak. Another one is stairs, just having to deal with stairs in a property. As you get older and your knees and body starts to not work as well as it used to, just the appeal of not having to live in a property with stairs. Going up the elevator, living on a single floor, it’s certainly an appealing way to live if you’re in that stage of life.

The idea of a new start or just a fresh start. Again, the kids are gone and you’re sort of in the same place. They’ve all moved out but you’re still in the same place. Maybe it’s time for you to have a new start, a fresh start as well. Social pressures, maybe your friends are all doing it or you perceive that your friends are all doing it. Your friends have taken the leap and have sold their homes and buying condos, so social pressure’s there. You want to be near them or hang out with where they are in a building or in an area of town where they’re now living in their condos. Maybe you want to be closer to your kids or closer to your grandkids. Maybe you live in one part of the city or one town and your kids and their families have moved to another part of the city, another town. You’re thinking you want to be closer to where they are and buying a condo near them might make sense.

The what if’s. What if’s, what if scenarios. Your mind starts to go to, “I’m getting older. What if the roof needs to be replaced? What if the furnace breaks? What if my windows leak? What if the fridge dies,” or whatever. You start thinking about all the unexpected expenses and cash flowing issues of owning a home. That’s where your mind is starting to go. The neighborhood has changed, so the neighborhood has turned over. Again, maybe you’re in an area, it’s all young families and your parents or you are not obviously a young family anymore. Your kids are all gone and just a feeling of the neighborhood has changed and just don’t belong here as the same way that we used to. Maybe you want to be closer to health care providers, doctors, nurses, and hospitals and other things that become more important as we age later in life and other amenities related to health and wellness needs. Property taxes, property taxes are getting too high. Again, in the retirement years being on fixed incomes in most cases then things like property taxes begin to take a mental toll and the thought of those going up while your income is not going up.

I think the biggest thing … Those are some of the reasons why people are thinking about, and maybe some of those are really ringing true with you, maybe there’s others, but I think the biggest thing that I see and that I want to address in this episode, not so much the lifestyle or the psychological aspects of it, but more so the looking at it from a purely financial perspective and trying to give you some advice, some free advice and hopefully something that’s useful to you is to encourage you to look at it purely from a financial perspective. Just looking at the dollars and cents of it and when it comes to this decision. I think that’s around, that’s surrounding the big why of this idea that, and it touches on a lot of the points I mentioned, is that feeling like you need the money. Why are you feeling the urge to sell your house and to buy a condo? It’s feeling like you need the money. You need that. You want to cash it out. It’s time to not have to worry about finances anymore and you feel like the solution to that, you’re sitting on a pile of cash and you just want to get that cash out of your house and into your pocket and you feel like that would be a great thing to do.

What I would say is that really the problem behind the problem that people are looking at is not that they need the money, not that they need the cash, it’s that they need the cash flow. There’s a difference there. You don’t need cash, you actually need cash flow. You need money coming in on a regular basis to sustain a high quality of life as you continue to age and as you are no longer working and earning an income, an income that is through decades previously had been coming in but also growing most likely with each year as you’ve taken on new jobs and new careers and as you’ve just grown over the decades your money, your income would increase. Now you’re in sort of more of a fixed income stage of life. What I would suggest is not that you need money, not that you need cash, but that you need cash flow. I want to talk about some potential ways that you can get that cash flow and address that problem, which is the need for cash flow in this episode here today.

To answer the question of, “Should your parents sell their house and buy a condo …” Before I get into my two or three potential solutions here that I want to present to you and ideas for you to bring to your parents or yourself, depending on who you are listening to this podcast … I suspect that most people listening to this podcast are similar to me. They are condo investors at the stage of life, you’re in your 20s, 30s, and 40s and your parents are at that stage of life in their 60s, 70s, and 80s where they are looking at potentially selling their house and buying a condo. Should your parents sell their house and buy a condo? Not to be a cop out, but the answer is maybe. It really, as I mentioned all the many factors and reasons why they might be looking at doing that, there’s not one be-all, said-all answer as to whether they should or not. It really depends on many different things in their situation.

The number one principle that I want to convey to you here in this episode is this: that the single family home in the GTA, in the greater Toronto area, is a rapidly appreciating asset. It’s, for most people, it’s the biggest asset that they have. The principle that I want to tell you here is you should hold onto that asset as long as you can. The single family home is a rapidly appreciating asset and you should hold onto that asset for as long as you can. My answer then, in effect, is look for ways to not sell your house. Look for ways to hold onto your house, especially if it is the only property that you own or that your parents own. Now obviously if you’re listening to this podcast and you are a condo investor or a would be condo investor, you’re preparing yourself to make that first investment and you’re looking to build a portfolio of properties over time, most likely when you reach the stage that your parents are in, this will really not be an issue at all from a financial perspective.

Maybe from a lifestyle perspective or psychological or other, but from a financial perspective, you are taking care of yourself for the future by buying investment properties today so that when you do reach that stage of life in your 60s, 70s, 80s when you are thinking about that downsizing decision, you’ve got properties that are giving you that cash flow every single month. You do not need to worry about this idea of cashing out and needing the money are not going to be concern to you, assuming that you have invested wisely and that you’ve held your properties over a long period of time. You’re going to put yourself in a fantastic position when you are at that age to not have any concerns about cash flow coming in every month. Even if you are thinking about selling your house at that point and moving into a condo, you’ve already got several condos that you own and you can probably just move into one of those condos that you already own if you choose to do that. It’s good to have you here. I’m glad you’re with me. That is what I’m doing with my long term financial plan. I truth that most people, most of you listening are also thinking along the same lines and wanting to invest in condos today for the similar reasons.

Now let’s get to my first potential solution here that I want to present to you. Instead of, again, the idea of holding onto that asset as long as you can, so instead of selling your house and buying a condo, number one I want to say think about using your home equity to solve your cash flow problem. Use your home equity, your HELOC, your home equity line of credit, HELOC, to solve your cash flow problem. Most people, if they’re thinking again, they’re thinking about selling their house, it’s because they have a cash flow problem. They need more cash coming in every month. Those same people, most of them, have a tremendous amount of equity in their homes, and a lot of people, their homes are completely paid off. They have no mortgage on them by the time that they are, again, in their 60s and 70s, certainly in their 80s. Not too many people in their 80s with mortgages thankfully. Getting back to what I was saying. Use your HELOC to solve your cash flow problem.

We’re in an incredibly great time in the sense that mortgage rates are so low, interest rates are so low, we as investors can take advantage of that. We can borrow money at very low rates and invest it at much higher rates. It’s a great opportunity. This also holds true for using your home equity line of credit. Let’s say you wanted to … Let’s say for most people I think $1,000 a month, $1,000 a month would be a tremendous help for most people in sort of their retirement years, having an extra $1,000 a month of income would be a tremendous help to sustain their lifestyle and to put aside any financial worries that they might have of being able to sustain themselves and live a high quality of life and fulfill all their obligations from month to month. Let’s say you want to get an extra $1,000 a month. You could borrow with the interest rates being what they are, they’re approximately three percent for home equity line of credit, you could take $1,000 a month out of your home tax free. Again, this is key, this is money coming into your pocket tax free.

If you take $1,000 a month out, you are paying the government nothing. You are getting $1,000 out and you’re putting $1,000 into your pocket. You’re not having to pay the government any taxes on that, which is a huge benefit of HELOCs. You’re getting $1,000 a month, $12,000 a year tax free at three percent. How much does that cost you in interest payments? Again, the advantage of a HELOC, you can pay interest only. You do not have to pay the principle portion. Interest only payments on $1,000 a month. Let’s say $12,000 in a year. $12,000 would be, it works out to $30 a month. $30 a month you pay to get $12,000 per year of extra income, cash in your pocket. Again, no taxes on that $12,000. $30 a month. $30 a month of course is hardly anything. It’s not even a cable bill these days.

Obviously if you’re going to do that, you’re going to collect interest, you’re going to collect debt over time and that debt will grow if you took out $1,000 a month every month over several years. That amount of debt is going to continue to grow. Let’s say you’re just paying the interest only. Let’s say you took $1,000 dollars a month out for 10 years, every month for 10 years. That’s $120,000 over ten years. How much interest would you pay over 10 years? I’ve done the math for you and the interest you would pay over 10 years, total interest over 10 years would be just under $20,000, $19,840. Let’s call it $20,000. You’d be paying $20,000 in interest payments on a monthly basis. That interest payment would grow with each month that goes by over those 10 years if you only pay the interest and did not pay the principle down at all. You’d be getting $1,000 a month for every month for 10 years and you would pay a total of $20,000 interest payments over those 10 years. After the 10 years, of course, you would still have a bill of $120,000, but you would maintain a very high quality of life over those 10 years.

Let’s say now … You’re saying, “Well, debt is bad.” You might be thinking, “Why would I do that Andrew? That doesn’t make sense. We should be paying things in cash, not using our house like a credit card to buy things.” What you’re missing out here is that over a 10 year period, do you think your property’s going to increase in value? Yes or no? I think there’s a 95% probability it will increase in value and it will probably increase in value significantly. 10 years is a very long period of time. It may go up, it may go down in some years over the next 10 years, but if you look at any 10 year period in the Toronto real estate market over the last forever, there’s really no, it’s never been a case where a property hasn’t gone up in value from year one to year 10. In fact, if you look at the long term appreciation rates for the GTA, they are about six percent per year. If you look over the last 50 years or so probably a little bit higher than six percent, but we’ll call it six percent a year is the long term average.

Over a 10 year period, you can assume that your property is probably going to appreciate at about six percent a year on average. Let’s say you had a home that was worth a modest amount in GTA of say $500,000 today. 10 years from now, if you were to do this plan, 10 years from now, that house would be worth, at again a modest appreciation rate average of six percent not even taking into account compounding, you’re looking at about, let’s say, $800,000 in 10 years. 500k today, six percent a year for 10 years, $800,000. That is an increase in value of $300,000 dollars. If you were selling that property today to cash out, so called, you’d be losing $300,000 of appreciation over the next 10 years. That $300,000 of appreciation would obviously much, much more than pay for the $120,000 of debt that you had incurred over the 10 years of maintaining a high quality of life. Also, it would obviously more than pay for the $20,000 of interest as well and you’d have about $160,000 still leftover in increase to property value after you’ve paid off those new obligations.

Why I like this solution … Let’s talk about what are the good aspects of this solution. One, it keeps the asset. That’s the most important thing I’ve talked about is it maintains ownership of the appreciating asset, that is your house. You don’t have to move obviously. It’s a seamless transition where this is no transition, you just stay in your home, which I think is appealing to a lot of people and takes a lot of stress out of it to be able to just simply age in place as it were, and stay in your home. You’re taking advantage of a low interest rate environment. Again, this advice makes sense today. If interest rate situation changes over the next 10 years, which it perhaps might, then this advice might not bear as much weight, but it makes sense right now. It’s certainly something that you can, strategy you can change on the fly. Those are some of the key reasons why I like that solution there. It’s something for you to maybe consider and think about for your situation. That’s number one.

Number two solution here to consider is, when it come to the question of, “Should you sell your house and buy a condo,” number two is consider this: rent a condo but keep your house. Rent a condo but keep your house. Basically in this scenario, you would keep your house and rent it out to a tenant and you would then move yourself into a condo that you rent. Rent your house and rent a condo. In this scenario, obviously again what I like about it is that you’re keeping the asset. You’re maintaining ownership of the rapidly appreciating asset that is your house. You are also enjoying the lifestyle of living in a condo because you’ve moved into a condo and you get to enjoy the condo lifestyle, the simple living and single floor, no stairs, low maintenance, lock the door and you’re gone sort of lifestyle. Also, you are a renter. When you are a renter, you have sort of the ultimate freedom. You can come and go as you please. You could move into one apartment and then if you don’t like it, just simply move into another. Within two months notice you can be gone. You could decide to move to a different city. You could move to a different country. You have the freedom and flexibility if you are a renter.

There’s certainly advantages there from a lifestyle perspective. It’s also a try it before you buy it sort of opportunity where you can try the condo lifestyle, see if it appeals to you. You might find that you hate it and you don’t like living in a condo. Some people do and they sell the house and they move into a condo and they’re stuck. They wish they could go back and they miss their yard or their garage or whatever it may be. Some people obviously absolutely love it, but it may not be for you. It’s a try it before you buy it sort of scenario. Again, in this idea the concept would be that you would be renting out your house for the same or very similar amount to what you would be renting out a condo for. Your monthly expenses are awash. That’s a good way to hold that property. Again, the principle here with owning a single family home is that doing this as opposed to selling your home and then buying a condo, the principle again is that your home is going to appreciate as a higher rate over a long period of time. It’s going to appreciate at a higher rate than a condo will.

You’ve already got the asset. You already own it. Why would you get rid of it to get into a lesser asset as it were? It’s very difficult, obviously, for people to enter into the housing market today, which is one of the reasons why condos are doing so well is people can’t afford houses and they’re now shifting to condos. It has always been and it will always be that houses will appreciate generally speaking at a faster rate than condos will over the long term. Not to say that condos won’t appreciate. Obviously that’s completely untrue, but if you look at appreciation rates over time, houses will generally do better than a condo. This is, again, a solution that allows you to keep that asset and to keep that thing that is appreciating at a … It’s the highest and best use of your capital so to speak is to keep your capital in a single family home if you can. That is the second solution there.

Those are the two main ones that I wanted to bring up. A couple other ones to consider to solve this issue of cash flow, one would be consider Airbnb-ing that extra room or those extra rooms in your house. Airbnb is obviously a fantastic tool for homeowners to get some extra income. If you have a big house and you’re not using the space, and perhaps there’s a way that you can separate one part of your house or one room of your house or whatnot … Airbnb, you have the flexibility of putting up whatever amount of your house that you want, whether it’s the whole house or part of the house or a room, and putting it up available at whatever price you want and whatever dates you want to make it available. You have the option there to potentially earn some extra income from your property in your retirement years. It would be fairly easy to get an extra $1,000 a month. Let’s say you rented a place for $100 a night, that’s 10 nights a month. Wouldn’t be too hard to do something like that. It’s an option to consider.

Another one to consider is what some people have done is what I like to call condo-ize your house. Condo-ize your house. Turn your house into that sort of condo lifestyle, low maintenance lifestyle by doing things like getting a professional property manager. Having someone cut your grass. Having someone shovel your snow. Just using services like, there’s apps and things out there like Jiffy On Demand where you can just simply push a button, boom, and a professional will come to your house and take care of whatever handyman or repairs or fix it things that need to be done. Just simply take the maintenance aspect out of owning a house out of it and sort of turn it into a condo. Instead of paying condo fees, you’re paying a little bit extra each month and you’re condo-izing sort of your own house and paying those fees towards making it a stress free and friction free and maintenance free property. If you’ve got things you’ve been putting off like replacing your furnace, air conditioner, roof, windows, doors, whatever it might be, do those things now. Consider doing those things now and making your home a maintenance free home for the next 10 years so that you can have sort of a condo lifestyle within your home for say the next 10 years or so.

There you have it. That is … Wow, that podcast has gone on quite a bit longer than I expected. A lot of ground we covered there. Hopefully you found some of this information useful. Maybe this is something that you can bring up at your next family dinner or gathering or whatever it might be, as the subject might come up with your family as it has often with mine. I hope you enjoyed this episode. If you did, why don’t you go ahead and share this with somebody or pass it along to somebody that you know who could benefit from it? Thank you very much for listening. Until next time, we’ll talk to you soon.

Speaker 2: Thanks for listening to the True Condos Podcast. Remember, your positive reviews make a big difference to the show. To learn more about condo investing, become a True Condo subscriber by visiting truecondos.com.