5 Reasons Why the Luxury Condo Market is About to Explode

“The Ritz Carlton continues to be one of the best bargains in Toronto. I think in time we will look back in future years in disbelief at the prices that people are getting these units for…”

I wrote these words in a blog post here.

The date was September 20, 2012.

At the time, units at the Ritz Carlton (183 Wellington) were going for around $700 per square foot.

I urged my clients to invest in this building (in my opinion one of the best buildings in Toronto), because I believed that it was massively undervalued and that in the future prices would be much higher for such a special building.

It turns out that I was right.

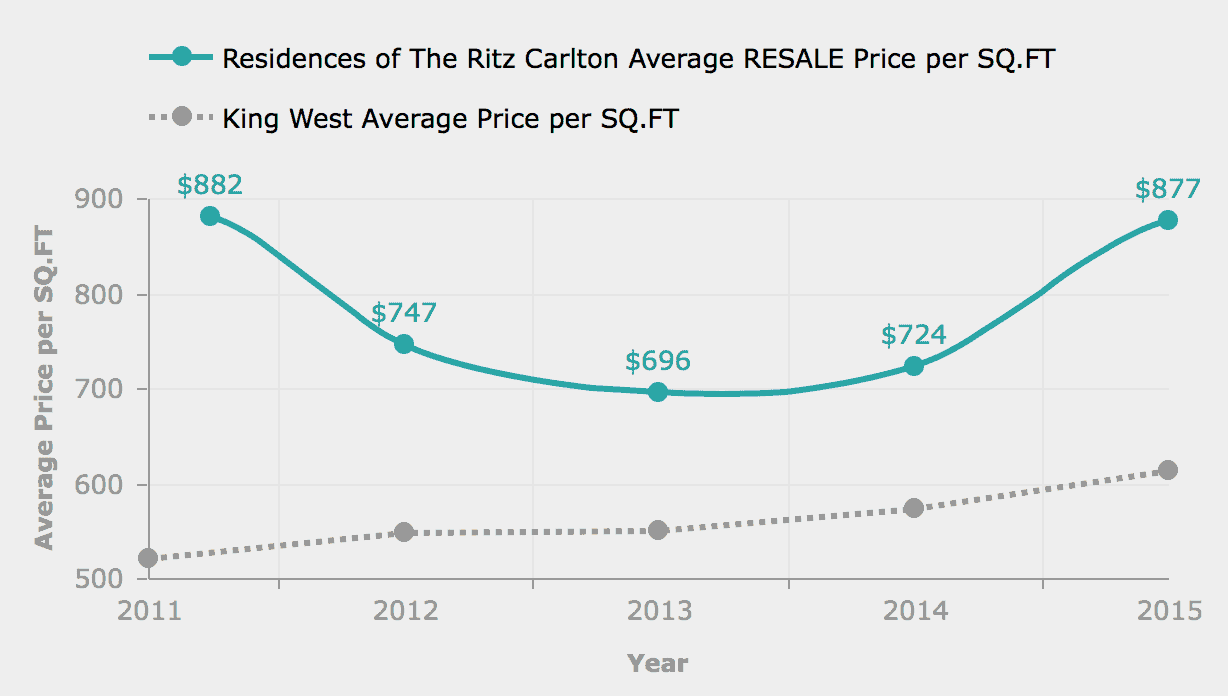

Prices at the Ritz bottomed out shortly after in 2013 and have been climbing steadily ever since.

Credit: Condos.ca

As you can see on this chart above from condos.ca, prices are now averaging close to $900 per square foot at the Ritz and 2015 saw a huge increase in prices of 21% over 2014.

Four units even sold for over $3M (an extremely rare number for a condo in 2012) over the past year at the Ritz and over $1000PSF.

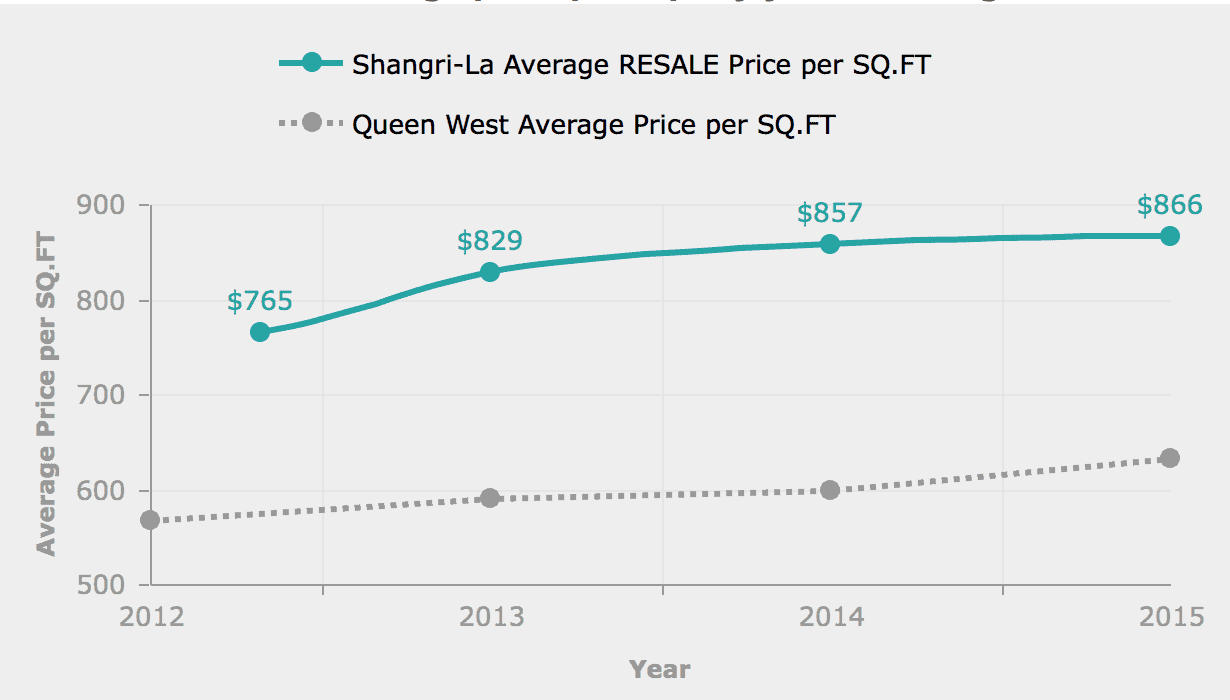

Taking a look at the nearby Shangri-La (see chart below from condos.ca), we see a similar story being told, albeit not quite as dramatic.

Credit: Condos.ca

High floor units at Shangri-La are fetching $1200PSF or more.

Rental rates have soared at both buildings as well.

I believe this is only the beginning for this segment of the market and I predict very strong price growth over the next 24 months.

Here are 4 reasons why I believe that the luxury condo market is about to explode.

1. Shortage of supply

When I wrote the original blog post back in 2012, there was 18 units on the MLS which at the time represented about 18 months worth of inventory.

Today there is only 4 units on the MLS which represents about 2.6 months of inventory!

Over at Shangri-La, 21 units have sold in the last year on MLS (and many more have sold through the developer NOT on MLS).

There are 15 units currently on MLS representing 8.6 months of inventory as per the MLS but the actual number is probably a lot lower because the developer has recently sold several units including a one 8-figure deal. These developer sales are not usually recorded on the MLS for privacy concerns.

2. Surging Demand

No question the demand is surging. 18 units have sold at the Ritz and 21 at Shangri-La (on MLS) in the last 12 months alone.

There are 2 main things that I believe are driving the demand right now and they are my next 2 points.

3. The Low Canadian Dollar

This is a big one.

It’s no secret that a large percentage (much larger than the overall condo market) in the luxury buildings are foreign buyers.

The recent drop of the Canadian dollar means that Toronto’s already low priced real estate is even cheaper by global standards.

I expect international buyers and even local buyer with earnings or holdings in foreign currencies to continue to snatch up units in these buildings in 2016.

4. The Increasingly Insane Toronto Housing Market

Have you been shopping for a home in Toronto lately?

This is what $3.5M gets you in central Toronto these days

5 years of double digit price increases have resulted in what some would argue is an insanely overpriced housing market.

Or you could argue that condos are insanely underpriced by comparison.

No matter which way you look at it, when you realize that buying a new or newer home in a prime Toronto neighbourhood (think Forest Hill, Rosedale, Leaside, Lawrence Park, etc) now will cost you about $1000PSF (e.g. a 3000 sq ft home will cost you about $3m), suddenly buying a high-end luxury condo with all the lifestyle benefits and amenities for around $900PSF located in the heart of downtown, steps away from the financial district and everything the city has to offer seems like a pretty sweet deal.

5. Value Proposition vs. Other Condos

Even though prices are starting to climb fast at the Ritz and the Shangri-La, these buildings still offer tremendous value in my opinion at around $900PSF.

Just look around at what larger units are selling for lately in regular condo buildings nearby.

Many units are selling for over $800PSF at buildings like 8 Mercer, Theatre Park, Cinema Tower, Peter Street condos, Charlie Condos, King-Charlotte condos.

Essentially the ‘regular’ condo market has now reached a new high of $800PSF so paying slightly more for the best of the best once again is a tremendous value proposition and one that I don’t think will be around much longer.

The gap between the regular condo prices and the 5-star buildings like Ritz and Shangri-La should be much bigger than it is.

My advice for buyers and investors:

Very simple: the time to get into this market is now.

If you are looking for a high-end condo in the luxury market, don’t delay. I predict that prices will rise significantly in the next 12-24 months.

My advice for sellers:

If you have a condo in one of these buildings, and you are thinking about selling, you might get a lot more value for it in a year.

If you don’t need to sell, you are better off holding the asset. The rental market is strong too.

Contact us today if you would like to discuss your options.