5 Things To Know About Craigslist Condo Rental Postings

Yesterday there was an article in The Globe and Mail which raised more than a few eyebrows in the Toronto condo industry, mine included.

The article cited a report by an investment research group based in Toronto that claimed they had analyzed advertisements on Craigslist and deduced that the condo market could be in for a major correction.Â

I just had to write a response to this article because I feel it is very irresponsible for the Globe and Mail to publish this story. This blog post is not an attack on the writer of the article, Tara Perkins, in fact I think that she is a great writer, but rather I want to address the findings from this report and the method used to generate these findings. [note: I do not have access to the report. I am only going by what information is in the Globe article]

Using an analysis of Craigslist ads to call for the downfall of the Toronto condo market is like asking a blind man to describe what an elephant looks like after touching it’s tail.

Since the report that is the topic of this article uses Craigslist listings to gather information, I thought that I would share with my readers 5 interesting facts about Craigslist condo rental ads that you might not know. This will help you understand why I think that this kind of analysis is essentially worthless.

[note: in this blog post when I say “Craigslist” I’m using it as a generic term to stand for all free online classified ad sites where you can post rental properties (like Kijiji]

1. Many Craigslist Ads Are Fake

Surprise! There is a lot of garbage on Craigslist! Many listings are not real or have been rented out weeks ago but never taken down.

Anyone who has rented an apartment in the last five years already knows this.

Many Realtors use Craigslist for generating renter and buyer leads. Bait and switch techniques are often employed where they put up a listing that seems too good to be true (because they are) to generate calls and emails from renters then they try to get them into other properties that actually do exist.

In contrast, the MLS system is tightly regulated and controlled. All listings are 100% real and are required to have a long paper trail behind them.

2. Asking Prices Are Not The Same As Selling Prices

Just because something was advertised at $1500/month on Craigslist, doesn’t mean that it will rent for $1500/month. Craigslist has no reporting mechanism for tracking what units actually rent for.

The report suggests that rental prices are falling based on their analysis of Craigslist asking prices. In reality we know that many listings sell for over the asking price due to bidding wars and depending on the time of year, while others sell for far below the asking price due to over pricing or if they are being leased at a slow time of year.

Relying on asking prices to tell you about rental prices is like analyzing car prices by looking at what the manufacturers ‘suggested retail price’ is. It doesn’t take into account the various options people choose on their cars, or the negotiations that take place.

The MLS is the only system that accurately tracks both asking and selling prices.

3. The Same Property Can Be Listed Multiple Times

As I said, Realtors use Craigslist for lead generation, and usually it’s Realtors who are new to the business or who don’t have any clients of their own, so they post other agents’ listings (with or without permission) on Craigslist to try to get leads.

The same listing might be promoted by 10 different Realtors. Does this mean that listings are up 1000%?

In contrast, on the MLS, a listing can only be posted one time by one Realtor.

4. ANYONE Can Post An Ad On Craigslist. ANYTHING Can Be Posted On Craigslist

The fact that anyone can contribute to sites like Craigslist and that it is free to post on Craigslist should be more than enough to realize this is not a place to source data on the Toronto condo market.

There are no standards (other than basic anti-discrimination policies) that have to be followed. Unlike the MLS system, there is no professional association or group or government agency who monitors the site or the validity of the ads. It’s the wild west of marketplaces.

5. Craigslist Ads Are Not An Equal Playing Field

Of the condo rental ads that are legit on Craigslist, some are posted by individual unit owners who are NOT paying a Realtor commission while others are posted by Realtors who are working on behalf of landlords and ARE earning a commission (usually 1 month’s rent plus HST).

Therefore simple math will tell you that individual landlords can rent their units for up to 9.4% less than Realtor-represented landlords and still net the same cash flow on a 1 year lease.

If and when landlords do undercut the Realtor-represented landlords, this skews pricing. Any analysis of data needs to take an apples-to-apples approach to have any validity. Lumping in two different types of landlords together doesn’t make sense.

Conclusion:

Trying to gain any insight into the condo market via analysis of Craigslist ads should be considered anecdotal at best. In reality, there are so many other sources of real hard data on the condo market that it doesn’t make any sense to look at this data other than for pure entertainment value. Taking this data seriously or making any decisions based on it is irresponsible and probably dumb.

BONUS: What’s Up With The Globe and Mail?

If you are a condo investor, you have to really look at where you are getting your information from on the market. Is it a reliable source? What is the bias of your source? You need to examine the facts before you make conclusions.

I Â have to say, this article got me really thinking why does the Globe in Mail in particular seem to be so anti-condo? Was it just me or is there actually a very biased approach by the newspaper on what is happening in the condo market?

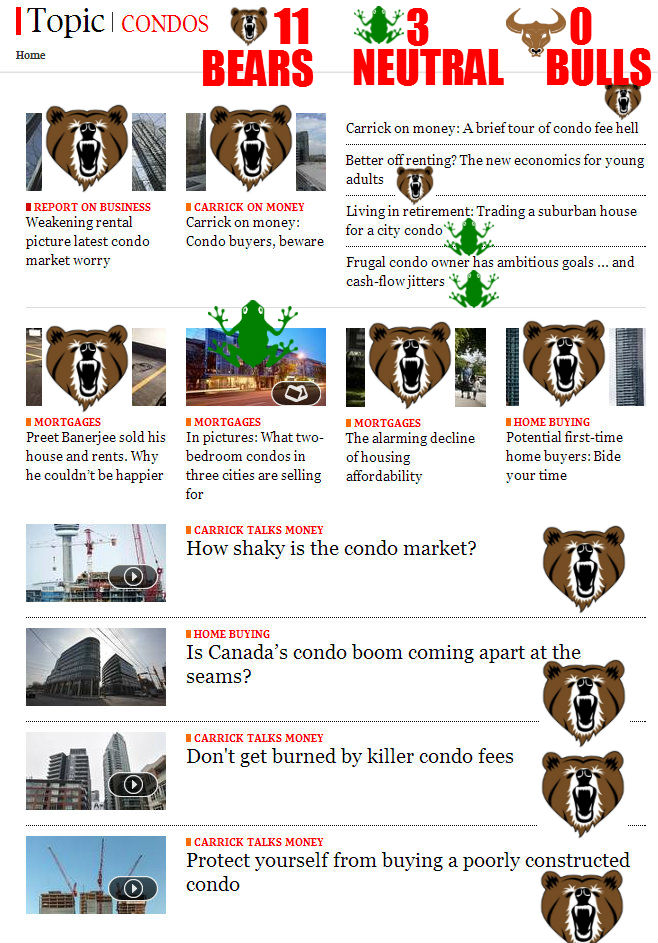

The Globe now has “topic” pages on their site where all related articles are grouped together. They have a “condo” page. When I clicked on it today I noticed something very interesting. 11 out of 14 articles are all strongly bearish on the condo market. 3 are neutral. 0 are bullish.

Come on Globe and Mail, I know that it’s tempting to write about how the sky is falling in the condo market, but the reality is this is not the case at all.

I want to challenge the editors at the Globe to include some bullish reporting on the condo market in 2014 to bring a more balanced approach to the news on our industry. We are a very important part of the Canadian economy and there are many reasons for optimism ahead. You can do better.

[Yes, I see the irony in posting anecdotal evidence of an anti-condo bias at the Globe in Mail in a blog post that is talking about how anecdotal reporting is worthless, but this is the only thing I have to go on at the moment]

See for yourself in this info-graphic I whipped together which is a screen shot of the condo page as of the morning of writing this blog post.