Two Trends to Watch in the Toronto Condo Market

There are two trends that condo buyers will want to keep an eye on in the next several years.

1. Disappearing Parking Spots.

There are now countless buildings downtown that are under construction that will have multiple-times more units than parking spots available. RCMI Condos by Tribute is actually being built with no parking spots at all. Mega towers like INDX and Massey that were both launched this year will have 600+ units each and only around 100 parking spots each. Only 1 out of every 6 or 7 units will have a parking spot! Compare this to buildings built even just 10 years ago where pretty much every unit came with a parking spot. Resale buyers today who need a parking spot area already feeling the pinch and are being restricted to a smaller and smaller portion of the overall condo marketplace.

Two things to take from this trend:

1. Consider buying a parking spot with your next investment condo. While it’s true that many downtowners are giving up on car ownership altogether, I find that those in the $100K+ income bracket still have cars and have no plans on getting rid of them.

2. Prices for parking spots have only one place to go: UP. The imbalance between units and parking spots being built today will result in very high prices in the near future. I could definitely foresee a parking spot in a non-luxury condo building go for $100K in the next 5 years.

2. Disappearing 2 bedroom Units.

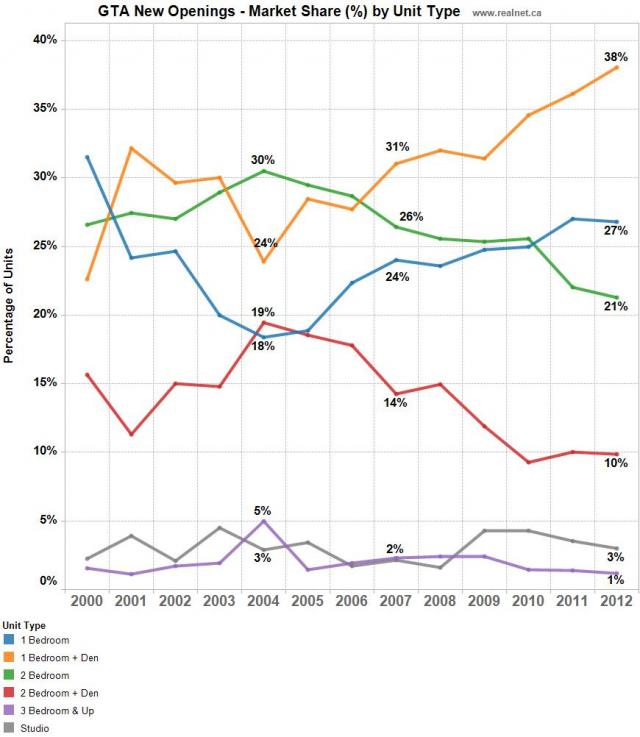

Check out this chart from Realnet which shows the breakdown of the different unit types for new condos in the last 12 years:

This chart shows a dramatic change over the last 8 years in the suite mix of new condominiums. In 2004, 2 bedroom and 2 bedroom+den suites made up 49% of the market and 1 bedroom and 1 bedroom+den suites made up 42% of the market. Today, in 2012, the 2 bedroom share is 31% (down 18%) and the 1 bedroom share is 65% (up 23%).

The obvious takeaway from this trend is that 3-5 years from now we may have a serious shortage of 2 bedroom units in the city. This is particularly interesting if you are an investor: consider buying a 2 bedroom unit in pre-construction today because a shortage of this type of unit could cause rental rates (and prices) to rise quicker than for 1 bedroom units. Move-up buyers who want to stay in a condo will have fewer and fewer choices as well pushing up demand for larger suites in the resale market.

Questions or comments? I’d love to hear from you.