Condo Investment: Is it Better To Buy On A Higher Floor or Lower Floor?

When investing in a pre-construction condo, a question that always comes up is:

“Is it better to buy on a lower floor, and pay a lower price, or to buy on a higher floor but pay a higher price?”

So let’s try to answer that classic, shall we?

Background

When selling a building in the pre-construction phase, every developer will have a base price for a particular unit then charge what is known as a “floor premium” as you go higher in the building for a particular unit.

Most floor premiums in most condos in Toronto are $1000 per floor for all units. Although sometimes you will see floor premiums of up to $2000/floor or more if the building is a low-rise building or if they are larger units or if they are units on the highest (penthouse levels) of a building.

TIP: Occasionally you will see a developer try this technique: floor premiums of “only” $500 per floor BUT invariably in those buildings the base price for the unit is higher than the neighbouring buildings nearby – in other words the average price of units end up being the same as the other buildings next door that are charging $1000/floor with a lower base price.

Custom Analysis by Urbanation

I am a subscriber to Urbanation. I pay thousands of dollars per year personally to get access to data on the Toronto condo market that I can’t get anywhere else.

Paying for data like this makes me a bit of an “odd duck” amongst my competition. Why do I pay money for numbers when 99.9% of all other Toronto Realtors would not pay for this information (Urbanation’s primary clients are developers and enterprise customers)? Because when it comes to condo investing, knowledge is power.

So much of the condo industry is driven by hype and marketing, but my clients rely on me to cut through the clutter and deliver the straight goods. Urbanation’s reports and analyses are one tool that helps me do that and my clients benefit tremendously from it.

So I asked my friend Shaun Hildebrand at Urbanation if he would help me run some analyses to answer this question of is it better as a pre-construction condo investor to buy HIGH or buy LOW?

The Findings

Shaun searched for a suitable building downtown that met the following general criteria:

-high rise with at least 30 storeys

-same floor plate all the way up the tower (so you can compare the same unit on the 10th floor as the 50th floor)

-the building had to have many transactions over the past year or so.

What Shaun quickly found was that there were no buildings that had enough resales to make this type of analysis useful or statistically significant.

But what he did find was that if you look at leases instead of resales, you could find some buildings that would provide you with enough transactions to tell a story.

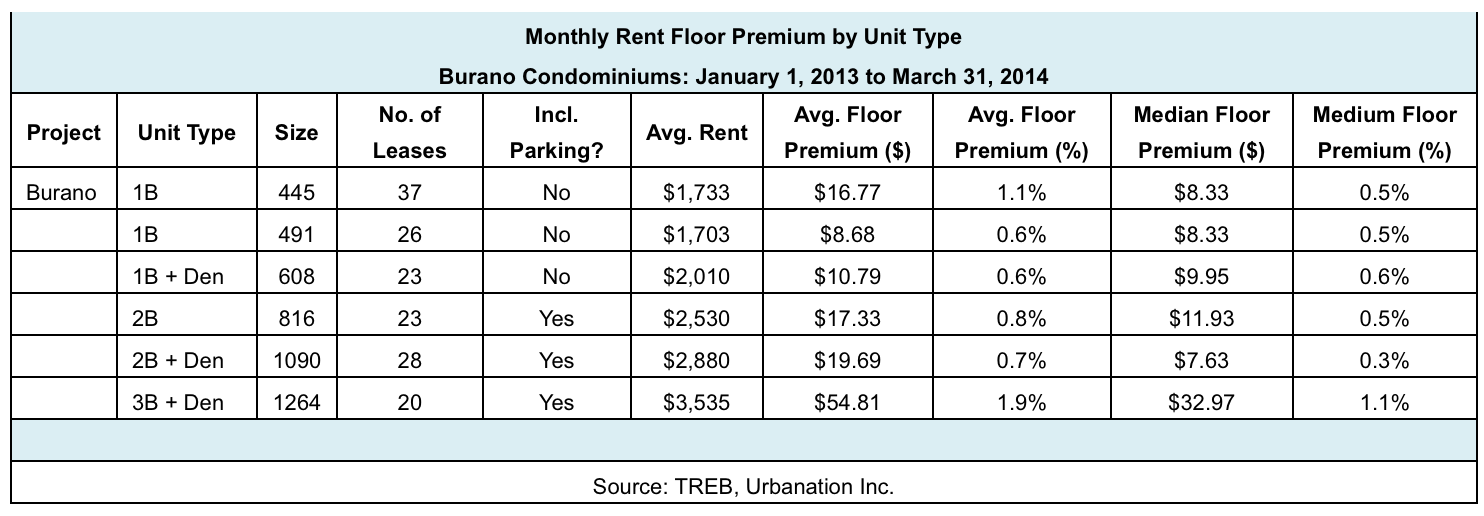

He found that Burano (condo by Lanterra developments at 832 Bay Street, 50 storeys) had a large number of leases and here is a summary of the data:

What the Data Says

The data we found provides an answer to the question of is higher or lower better, but in a round about way.

Instead of showing what you will be able to resell your unit for if you pay an extra $1000/floor for it, we were able to show how much more you will be able to rent your unit for if you buy on a higher floor.

So we showed the extra income but not the extra appreciation in price itself.

That said, I took a few insights from this data:

Insight #1: Higher Floors DO get Higher Rents

The numbers for Burano shows that as you go up in the building and pay more for the privilege, you will get higher rents. This is very important because some investors still believe that they will not get higher rents if they buy on a higher floor and they will use this as a reason to only ‘buy low’. So don’t buy low just because you think you will not get higher rents if you go higher.

Insight #2: Higher Is Better

The big question this answers is that when you are investing in a pre-construction condo, it is better to go higher. Think of it like this: for a median floor premium of $8.33/floor/month that works out to $100/year. An extra $100/year on a $1000 initial investment means you are getting a 10% cap rate which is very good.

If you can get a 10% cap rate on a condo investment, you should take that all day long!

Higher is better.

Insight #3: 3 Bedrooms get the Highest Floor Premium

This was really interesting to see that the largest floor premiums by far were for the 3 bedroom units. Landlords of 3 bedroom units saw an average increase of $54/month or $648/year for every floor up they went.

If buyers paid only a $1000 per floor, than that works out to an astonishing 64.8% cap rate!

I don’t think this is a universal rule but investors who bought the 3-bedroom units on high floors in this building are doing very well at Burano.

Why are renters willing to pay such high floor premiums for these 3-bedroom units? My theory is that if you are already shelling out $3000+ per month for rent, what’s another $200-300/month for an outstanding view? High end renters will pay big premiums for premium views.

Insight #4: Renters Will Pay a Premium for Premium Views

Check out the 1-bedroom units on this chart. The 445 sq ft unit faces south, the 491 faces north. Even though the average rental price for both units does not show much difference, the average floor premium for the south facing unit is about twice that of the north facing unit ($16 per floor vs. $8).

How I interpret this is that the highest floors of the south facing unit command such a HUGE premium over the lower floors that it brings the average rental premium per floor up. On the other hand, for the north facing units, renters will not pay as much of a premium to go up very high. The reason for this is that the views to the south on high floors are spectacular towards the lake and the CN Tower and a high floor view is a very whereas the views to the north don’t really improve much as you ascend the tower.

So if it comes down to paying a large floor premium for buying a north facing or south facing unit, you are better to go with the south facing unit (assuming the view facing south is highly preferred to the north view in the building you are considering).

What the Data Does Not Say

While these findings are interesting, they are only 1 data set from 1 building, and it’s only for rental rates.

So take this all with a grain of salt. I consider this strong anecdotal evidence to support buying on higher floors is better than on lower floors but it’s not an empirical study by any means.

Unfortunately the bigger question remains: what will buyers on the resale market pay for a higher floor vs. a lower floor? For example, if you buy on the 50th floor, and you pay a $40k premium to do so, will you get at least $40k more when you resell than if you bought on the 10th floor?

Another thing these calculations do not take into account are increased property taxes for going up higher in a building (purchase price is higher) or increased mortgage payments for going up higher.

Conclusion

I hope you found this information useful for your condo investments. Let me know what you think. And if you want more info like this sent directly to your inbox, make sure you become a True Condos subscriber.