3 Scary Statistics That Show Just How Hot The Downtown Condo Market Is Right Now

The downtown condo market is so hot right now it’s scary! The numbers reached historical levels earlier in 2016 and the market is still accelerating. In this episode, Andrew la Fleur shares 3 statistics about the downtown condo market that will shock and surprise you. If you’re in the condo market already it’s great news, if you are still on the sidelines, now is the time to jump in – listen to find out why.

EPISODE HIGHLIGHTS

2:27 Average number over the last 12 years sales-to-listing ratio for condos downtown.

2:58 The condo market is the buyer’s market.

4:45 November month 2009, the highest November ever.

6:40 There’s nothing available to buy.

7:25 How many active listings there are in the entire downtown core?

9:30 This market is nothing like we’ve seen before.

10:13 Condos.ca for statistics

11:45 The market is actually speeding up.

12:30 The average price, according to condos.ca for a condo sold in the last two weeks.

13:30 How have condo prices moved in the last 60 days alone.

14:50 What do we take on this a a condo investor?

15:00 Expect more rapid increases in the next few months.

15:55 Pre-construction is a great buy right now and I’ll tell you why.

17:07 Buying pre-construction condos downtown under $700 PSF are almost over.

18:50 If you own a condo, do not sell it.

Click Here for Episode Transcript

Andrew la Fleur: Just how hot is the downtown Toronto condo market? Well, on today’s episode I’m going to share with you three scary statistics that will show you how hot the market is, and what you should do about it. Stay tuned.

Speaker 2: Welcome to the True Condos podcast with Andrew La Fleur. The place to get the truth on the Toronto condo market and condo investing in Toronto.

Andrew la Fleur: Hello and welcome back to the show. Once again, it’s Andrew La Fleur here, your host as always and thank you for listening.

As I said in the interim I’m going to talk about how hot the market is right now and we’re going to jump into three scary statistics I’m going to share with you. Some might call them scary, I guess. If you’re not in the market, they’re scary. If you’re in the market, they’re fantastic. They’re amazing news to hear, if you’ve already invested in the condo market.

One of my favorite statistics, the number one stat that I always go to … By the way, we’re talking about the resale condo market here today, not the pre-construction market. We’re talking about existing resale condos downtown. Downtown as defined by south of Bloor, west of the Don Valley, and east of sort of Liberty Village, and east kind of thing. That’s what we’re talking about when we’re talking about the downtown condo market.

My favorite statistic that I always go back to and if people ask me, “How’s the market?” the number one thing that I go to, to find out statistically speaking how the market is doing, is I always look at the sales-to-listing ratio; the sales-to-listing ratio.

In the sales-to-listing ratio, more than average price or number of sales or any other stat, days on the market, the sales-to-listing ratio is going to give you the best snapshot of how the market is doing in one simple statistic. The number of sales in a given month is a ratio of the number of available properties for sale in a given month, so sales to active listings, if you want to get technical.

When you track that stat over time in the downtown core, as I have for the last 12 years of so, I’ve got a spreadsheet that tracks this over the last 12 years for the downtown core, the average number over the last 12 years, the sales-to-listing ratio for condos downtown, this is just for condos again by the way, is somewhere around 30%, 25, 30%, is an average. That represents a buyer’s market for the most part. Once it gets above sort of 45, 50%, you’re heading into more of a seller’s market, traditionally speaking.

Most of the time the condo market is a buyer’s market. Not a strong, severe buyer’s market; that would be more like 10 or 15%. It’s only dipped down to those levels probably once, which was in the Recession of 2008. Most of the time the market is sitting somewhere between 25, 30, 35%. That’s where you can find it and that’s sort of a typical number to expect for the downtown condo market. Things are moving but things are not flying off the shelves, so to speak.

The number for the most recent month we have, which is November, is absolutely off the charts. It’s the highest sales-to-listing ratio that I’ve ever seen, ever tracked, and probably has ever been in the condo market ever. Even though my stats only go back to about 2004, it’s probably never been higher than this before that too.

The number now is sitting around 94%; 94% which is insane. We’ve never seen anything like it. The highest November month ever that I could see since 2004 was around 70% and that was in 2009. 2009 November, if you recall, that was coming out of the Recession. The Recession started in the fall of 2008, lasted about six months. Government put a bunch of stimulus into the economy, lowered interest rates, and the market really began to take off around June of 2009 and kept going steady for about a year. Very strong, the market was then.

The November month 2009, that’s the highest November ever at around 70% sales-to-listing ratio. At that time, there was bidding wars everywhere and things were nuts. Now we’re sitting at 94%. It’s absolutely unheard of, it’s unprecedented. There’s nothing like it, I mean the highest number for any month ever.

Again, you really shouldn’t compare November month to a non-November month because real estate, especially in the resale market, is highly seasonal. Even if you do cross any month ever, the highest number that I could see was around 80, 85%, something like that in a spring or a summer market. This is incredible, 94% in November when it’s typically a slower time of year, crazy, crazy.

Basically every single property that is coming onto the market is selling effectively in the same month. That’s what this number is sort of telling us. A year ago, I mean what a difference a year makes. The market has changed so much in a year. We’re at 94% today, a year ago for the downtown west market, it was about 29% versus, so it’s tripled. It’s just crazy the change in a year is incredible. You just can’t even wrap your head around it.

For downtown east the number a year ago was a little bit higher, it was 45%, which was actually very high historically speaking. For downtown east 45% a year ago and now again, it’s around 94% for downtown east as well. Absolutely incredible number there. That’s the first number I want to share with you.

The second scary statistic that just jumps off the page is there’s nothing available to buy. Everyone’s saying, “What is driving this? Why is everything so crazy? Why are there bidding wars on all these condos everywhere?” Old condos from the 1980’s are getting four or five offers on them, that need complete gut jobs pretty much.

What’s going on here? It’s all driven by supply and demand. Right? Demand is strong, of course we know that. Demand has always been there. Nothing has really changed as respect to that. It’s growing yes, but it’s always been strong. But it’s supply. There’s nothing to buy, there’s no inventory. Everything has been bought up this year and there’s nothing on the market.

Let’s take a look at the numbers on the inventory side. The second statistic I want to share with you here is how many active listings there are in the entire downtown core. The entire downtown core for the resale condo market in the month of November, there was around 670 active listings; 670 active listings.

That is ridiculously low. The number last year was about double that at this time. The lowest number … I had to go back to 2004 to find a November with a number even close to that. Even in 2004 there were more condos available for sale in November 2004 downtown than there are today in 2016. Think about that for a moment. There were more condos available for sale downtown in 2004 than there are today in 2016.

Think about how many condos have been built since 2004 in the downtown core. I don’t know what that number is exactly, but it’s in the tens of thousands. Okay? There are less condos available to purchase today than there was 12 years ago. Absolutely nuts.

There were again, it was about 100,000 people being added to the GGA every year. That means there’s 1.2 million people more in this city needing a place to live, than there was the last time there were this many condos available for sale; when supply was at this level.

The city has grown by over a million people and yet there’s less properties available to buy now with a million more people in the city. Absolutely incredible. This market is unlike anything we’ve ever seen before and it begs the question of course, where does it go from here? We’ll talk about that in a minute.

The next and the third statistic I want to share with you is look at average prices. For this one I’m jumping over to one of my favorite websites, which is condos.ca. I have no affiliation with them but it’s just a fantastic website run by a good friend of mine, Carl Langschmidt. He’s just got a fantastic resource there at condos.ca for looking at statistics.

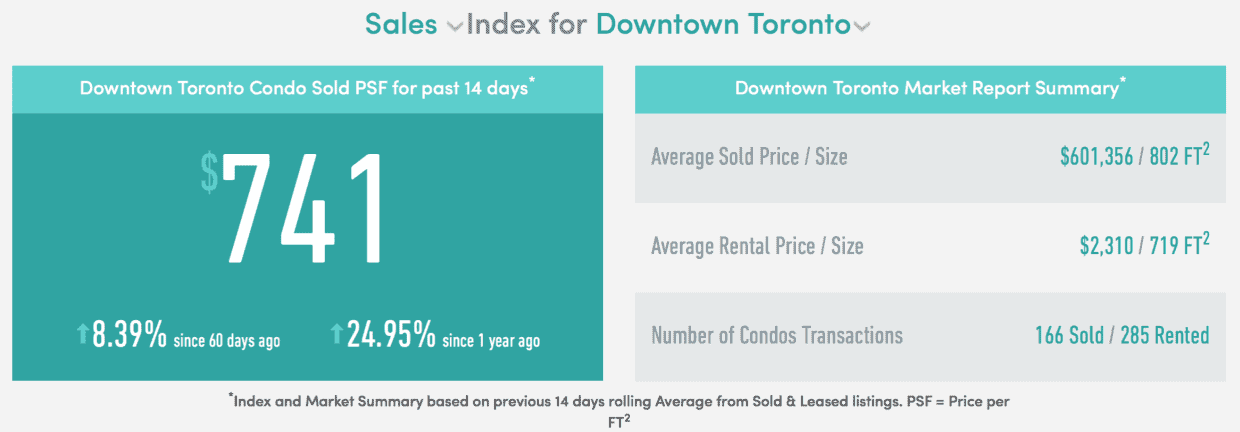

Their stats show … They actually have a new feature on the home page which is updated daily, I believe. It’s basically showing how the condo prices are moving on a sort of day-to-day basis, versus a year before. The latest stats as of today, recording of this podcast, December 8th, is showing that condo prices over the last two weeks, it just tracks the last two weeks so you really get a good sense of where the market is at this minute. From the last two weeks the condo prices for the downtown core are up – get this – 25%. Condo prices are up 25% compared to last year.

Again, this is insane. We’re used to sort of the condo market chugging along at 3, 4, 5, 6%. If we get a 8 or 9% month or year here and there, then we’re patting ourselves on the back and congratulating ourselves as condo investors and people in the condominium industry as it was a fantastic year. Prices are up 25% and I’ve been looking at this number over the past couple of weeks, as they’ve just added this new feature on that site. It was around 15% and then 16, 17, 18.

It’s tracking up. The market is actually speeding up and again, this is all driven by the lack of supply. There’s fewer and fewer properties available to buy so everything is going up in bidding wars, and prices are soaring; soaring up to new heights never seen before. As a result, the average price are up 25%. This is by the way, not average sale price but actually the per square foot price. It’s probably a more accurate and useful statistic because it’s just based on the per square foot prices. It’s not affected by larger or smaller units selling. It’s an average of the entire market overall.

The average price, according to condos.ca for a condo sold in the last two weeks downtown, the average price per square foot in the resale market, would you believe is $741 per square foot. $741 is now the average price of all condos sold across all of downtown, including Yonge and Bloor, including Cityplace, including Liberty Village, including King East, King West, Youngstreet.

Everything all bunched together, the average price is $741 per square foot. Which again, just maybe two years ago if you were looking or buying a condo that was $700 a square foot, that was considered like an ultra-luxury, “Woow! I can’t believe you’re paying that price!” kind of a condo. Now just the average condo price is over $700 a square foot currently. Wow!

Taking it even a step further, they are looking at how have condo prices moved in the last 60 days alone. They have that number as well and according to their stats in the last 60 days alone, the condo market prices have actually increased downtown by 8.39% over the last 60 days; 8% increase in the last 60 days.

If you extrapolate the last 60 day rate over a year, an annual basis, then that represents a 50% annual increase in prices. 50% annual increase based on how the market has been trending over the last 60 days. Now it’s not to say that that’s going to continue and that a year from now prices of condos will be up 50% from where they are now. I certainly hope that doesn’t happen because that would definitely be a bubble, but that is what the market is doing right now.

Okay, so those are the three scary statistics – say that three times fast – three scary statistics, three … Those are the stats, so what? I want to obviously look at how do we apply this or what do we take from this as condo investors, so here’s my take-aways and my applications, my so-what’s.

Number one. Expect more rapid price increases over the next few months, expect more bidding wars. The lack of … This is not going to change, in fact as I mentioned the pace is actually accelerating. Condo prices were up 10% a few months ago. Then they’re trending 15%, then 20 a couple weeks ago. Now they’re trending 25% up.

Expect more rapid price increases in the downtown condo market over the next few months. Nothing’s going to change unless we get a massive influx of new supply, or there’s some kind of a shock to demand, if interest rates suddenly went up a lot, which doesn’t look like they’re going to do that. If there’s some kind of a recession or Trump does something crazy or pushes a crazy button but short of that, expect more rapid price increases and bidding wars over the next few months.

Number two. Pre-construction is a great buy right now and I’ll tell you why. If you can buy … What’s nice about buying pre-construction in this kind of a market is developers set their prices and the prices of condos are much more static. Pre-construction is much more static compared to resale. Individual sellers in the resale market, they adjust their prices by the day.

Pre-construction condos for the most part are not able to do that. It’s much harder to turn a very large ship, if you will. If you’re purchasing a pre-construction in the current market, it’s like you’re frozen in time in the market. You can freeze that price, or that price is effectively frozen. Yet the market is sailing, is skating by you at a very rapid pace. If you’re buying today, you can see gains in a very short period of time where you might buy today and prices might go up 10, 20, 30, 40,000 a week, two weeks, three weeks later. Buying pre-construction right now, obviously with the right opportunity, is a very good option.

Number three. The days of buying pre-construction condos downtown for under $700 per square foot sadly are nearly over. You heard it here first. The days of buying a product under $700 a square foot is nearly gone. Again, we used to look for product at $400 a square foot as the value. Then we looked for $500 and then $600 was the mark.

Now today, there’s very little product anywhere downtown under $700 a square foot. If you think that’s high, again you are out of touch with what is happening in the resale market. Take a look again. The average price resale market right now is $741 per square foot for downtown. If you are buying product pre-construction for under $741 per square foot downtown, as a general rule of thumb, you are doing well. You are going to do great with that investment. Get them while you can.

Again, the two projects that I would point out to investors right now for a product in that sort of category downtown, one would be Minto west side. There is still a handful of units there available in the $600’s per square foot. Great project, great building, great builder. The other one is Home Condos on the east side. Home Condos again, also has some great units under $700 a square foot, and please contact me directly, andrew@truecondos.com or call me 416-371-2333, for more information on those projects.

Number four. The final point, if you own a condo, do not sell it. It is not a good time to sell. I’ve talked about this on the podcast from earlier episodes this year, when the market was starting to heat up. Do not sell your condo right now. Hang on to it. Your condo is appreciating very rapidly, even if you can’t feel it or see it. It is not a good market to sell in. You’re leaving money on the table, if you’re selling today.

Don’t sell unless you absolutely have to, because your condo is doing very well right now and it’s appreciating at a fast rate, so hang on to it. Wait for a slower time in the market to sell because that makes more sense. It doesn’t make sense to sell it when the market is rising so quickly.

Okay, there you have it. That is today’s episode. I hope you enjoyed it. Three scary statistics and what to do about it. Feel free to share this with a friend or somebody who’s saying, “Man, I can’t believe how many condos they’re building in Toronto. There’s too many of them. It’s a condo bubble.” Whatever nonsense you’ve been hearing at your Uncle Frank’s house or at the coffee shop or whatever.

Set them straight, give them some real numbers and some stats and some analysis, and send this podcast over to them. Okay, thanks for listening and till next time, have a great week.

Speaker 2: Thanks for listening to the True Condos podcast. Remember, your positive reviews make a big difference to the show. To learn more about condo investing, become a True Condo subscriber by visiting truecondos.com.