5 Shocking Truths About The Toronto Condo Market That No One Is Talking About

1. The Condo Market is Bigger and Hotter Than Ever Before

The media is so obsessed with the skyrocketing prices and bidding wars taking place across the GTA in the low rise housing market that people are missing the fact that the condo market is booming once again after a relatively slow last couple of years.

And while everyone loves to talk about the pre-construction condo market – the number of sales, the records that keep getting broken, the truth is that the resale market – both for rentals and for sales – is the “real” condo market.

What do I mean by this?

90% of all pre-construction sales are to investors – people who are buying with no intention of using the property themselves for a place to live.

On the other hand, when a condo is leased or sold in the resale market, 90% of the time this is to a real person who is moving into the unit themselves – and moving in immediately.

The numbers in the pre-construction market can go up or down, but this doesn’t really tell you what’s happening on the ground, in “the street” with the actual existing supply of condos in the marketplace.

So if you want to know what’s really going on in the condo market, do what I do every month: look at the resale market statistics.

Let’s do that now, but first…

2. Condo Sales Figures Are Only Half The Story

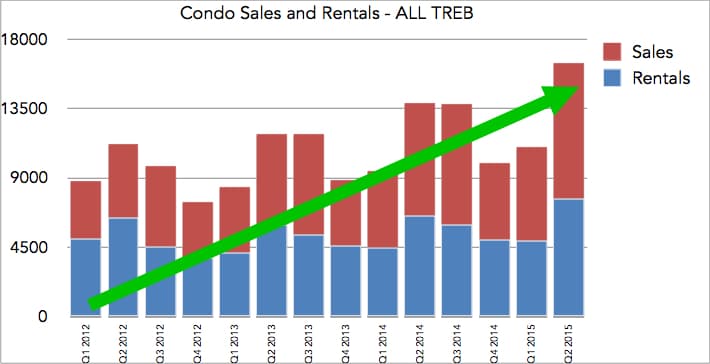

The resale condo market is made up of sales AND rentals.

For whatever reason, the media chooses to focus its reporting only on sales and rarely talks about rentals, and NEVER talks about them together.

The reality is that when you look at sales and rentals together you get a much more accurate picture of what is happening in the condo market and the direction the market is heading.

The narrative in the media over the last 3-4 years has been that the condo market is slow, the condo market is a buyers’ market, the condo market has fallen off what it once was in the peak of the market from 2007-2010.

The underlying, sometimes spoken, sometimes not bias of most mainstream media reporting is that the condo market is due for a crash.

And it’s true that if you just look at sales of condos in the resale market you would draw the conclusion that the market is pretty much flat over the last few years overall.

However, when you add in the story that is happening in the rental market, you quickly can see that the market is bigger and hotter than ever before.

Don’t believe me? Let’s take a look at some numbers…

3. The resale condo market has grown by 47% in the last 3 years

If you only read the headlines in the newspaper you might have missed something pretty incredible about the Toronto condo market: it’s grown by 47% in the last 3 years.

That’s a very high number!

In the second quarter of 2012, there were 11,206 condos sold or leased out.

In the second quarter of 2015, that number has soared to 16,477.

No other quarter in history has ever come close to this number.

People are moving into condos in all-time high numbers.

This is not a trend that will end any time soon.

4. Sales have grown by 19% in the last 3 years.

Breaking out just the sales figures and not the rentals, sales are up 19% from Q2 2012 to Q2 2015.

More real people are buying and moving into condos than ever before.

2015 will likely break the all time record year of 2007 for condo sales.

5. Rentals have grown by 85% in the last 3 years.

The biggest part of the growth in the condo market has been in rentals.

The number of condos rented out on the MLS system has nearly doubled in just the last 3 years.

4771 condos were rented out in Q2 2012 compared to 8821 in Q2 2015.

When you add up the growth in sales and rentals, the condo market has seen a huge expansion in the last few years.

Now That You Know the Truth…What does the future hold for the condo market?

Condos will be the only choice for first time buyers.

With low rise home prices completely out of reach for the typical first time buyer, condos will become the de facto option for virtually all first time home buyers.

In fact, this is already the case today, with many buyers ignoring the housing market completely and looking to get into a condo for their first purchase.

Demand will continue to be strong for condos.

The nay-sayers who continue to call for a condo market crash seem to believe the fallacy that the low rise and high rise markets are operating in separate universes.

How can the low rise market go up 10% per year and at the same time the condo market is going to go down 10% in a year?

It can’t. It won’t.

The housing market is one market and changes in one area of the market have an effect on all areas of the market.

As more and more buyers are priced out of the low rise market, they will shift to the condo market by default.

Prices and rents will continue to rise.

Growing demand for condos = increasing prices.

You can see from the earlier chart that the real condo market is growing at a very strong pace.

As long as this continues, you can expect prices and rents to also continue to rise.

Unlike the low rise housing market, the increases in the condo market are single-digit and sustainable.

Demand for larger suites will increase.

Demand for larger units, 800 square feet or more will see a surge in the years to come.

New buildings being sold today for completion in 3-5 years have fewer and fewer options for suites over 800 square feet.

750 sq ft is now the largest unit in many buildings downtown.

Young couples and young families priced out of the low rise housing market will be looking to move into these larger units for a few years whereas 10 years ago, they would simply jump from a 1 bedroom condo to a semi-detached house in the city.

**NOTE** this is not to say that demand for smaller units (studios, 1 bedrooms, and 1 bedroom+dens) will decrease, the smaller units will always be the most popular units. However, 5 years ago I would never advise my clients to consider a 2 or 3 bedroom, now it’s time to start thinking about adding some to your portfolio.

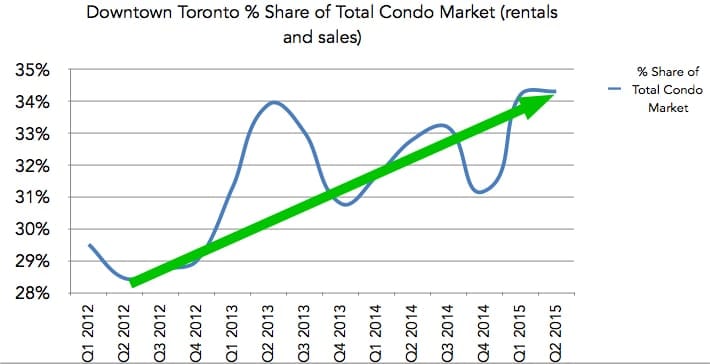

Downtown is still the primary place to invest your money in the condo market

As the city continues to grow, commutes continue to get longer and longer every year, and more and more jobs are located in the core, the downtown is the smartest place to invest.

Over the last few years, the downtown condo rental market is taking up a growing percentage share of the overall condo rental market.

Expect this trend to continue, and resist the urge to invest in periphery areas, or areas not well served by transit. These are the areas that on paper are cheaper to buy, but in the long run will cost you a lot more.