5 Responses to The Bank of Canada’s Comments About the Toronto Condo Market

The Bank of Canada issued a warning last week that the Toronto condo market is a risk to the Canadian economy. Some of my clients have been asking me for a response. Here it is.

1. Condo sales should not be analyzed in isolation of new home sales

This is the most important point that I can make. We need to stop looking at condo sales in isolation of new home sales.

Any analysis as to the state of the new condo market needs to also look at what is happening in the new home market.Â

The new home market has dramatically shifted from primarily low-rise (single family homes, aka McMansions in the burbs) to primarily high-rise (concrete condo towers). This is not a phenomena that can be explained away as “the condo bubble”.

Toronto is fundamentally shifting away from a primarily low rise city to a high-rise city. This trend has been happening for at least a decade and will continue for many reasons: intensification policies, growing commuting times, gas prices, demographic trends, global urbanization trends etc.

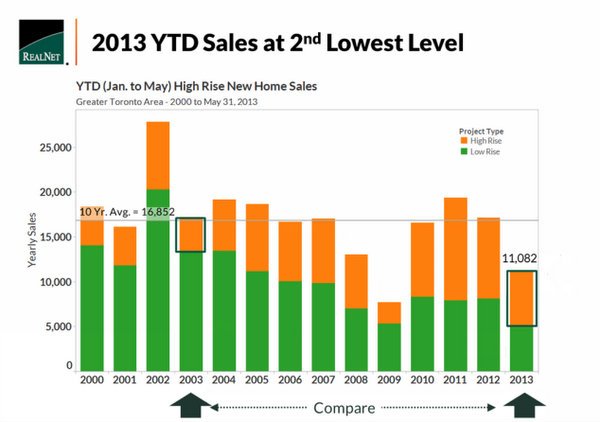

Chart Courtesy Realnet

The charts above clearly shows the housing flip that has taken place in the last decade: the number of new low rise homes continues to shrink while high rise continues to grow. The overall number of new home inventory has remained relatively consistent with the exception of this year and the recession years of 2008/2009.

Why wasn’t there any talk of overbuilding in the early 2000s when builders were selling low rise homes like hot cakes? Possibly because no one in Toronto can see a subdivision in Markham or Whitby with 300 homes going up, but a 40 storey tower on Yonge street is impossible to miss.

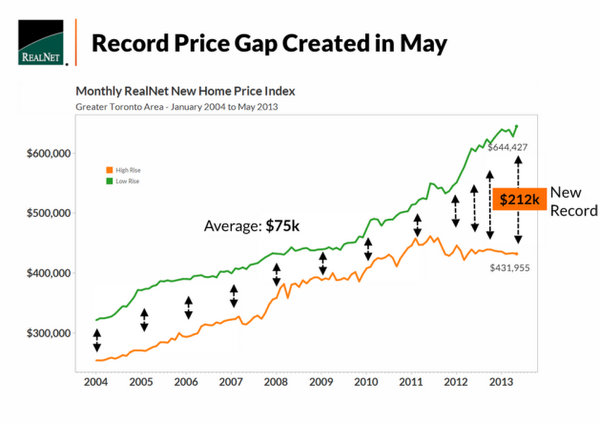

Chart courtesy Realnet

And while condos are still an affordable option for first time buyers, the dream of owning a home is quickly slipping away as the price gap between homes and condos continues to widen. I suggest the Bank of Canada raise a red flag on this issue if anything (see chart above).

2. Housing starts are a bad indicator of market conditions

The Bank of Canada talked about how construction activity (housing starts and units under construction) is still very high despite declining sales. This clearly illustrates that the Bank does not understand the fundamentals of the condo market.

Housing start numbers make for great headlines. If housing starts are up that must mean the market is up and if housing starts are down that must mean the market is down, right? Wrong, it’s not that simple.

Housing starts include both condo starts and house starts. They are two totally different animals.

Houses are generally sold and built one at a time. Houses take about 1 year to build.

Condos on the other hand, require hundreds of units to be sold before even one gets built. Selling hundreds of units often takes 1-2 years. All of the units need to be built at the same time, but building them takes usually 3-4 years. A 50-70 storey tower can take 5-6 years.

You can see the problem that arises when you try to draw any conclusions from housing starts when the numbers include both low rise and high rise numbers.

3. The market is already correcting itself

The Bank of Canada seems to be still waiting for a correction, and wondering why it hasn’t happened yet. Â Stop waiting BoC because it’s already happening!

The beauty of the new home market is that it is largely self correcting. When the market slows down as it has over the last 12 months, developers put their plans on hold for new projects – particularly in the condominium sector of new housing. You can build one house at a time, but you can’t build one condo at a time, you must build all 300+ units at once.

Year-to-date sales of new homes (condos+houses) so far in 2013 are the second lowest on record. If a condo tower doesn’t sell 70% of their units it will never get built. If just 4 or 5 condo buildings in the GTA are cancelled in 2013 this would remove about 10% of the entire market of unsold high rise homes – a scenario that I find entirely possible and one that would instantly put upward pressure on prices of those projects remaining in the market.

Which projects are selling today? The ones that priced their units about 5% below what they would have launched at last year. These projects are selling incredibly well. Hundreds of units are being sold in days.

Which projects are not selling? Many projects that launched in the heydays of 2011 and early 2012 that have not adjusted their prices accordingly. These projects are stuck at 30-50% sold out and if they do not lower their prices they will never hit 70% sold for construction and they will be cancelled (the exception is the projects by very deep pocketed developers who can afford to simply wait another year for the market to catch up).

4. Construction capacity limits

Finally, a point that continues to be worth mentioning is that we have a construction capacity issue in Toronto. We have never completed more than about 35,000 new homes (condos plus houses) in a year. Population growth alone sits at about 35,000 new households per year. It is unlikely that we will ever have one of these apocalyptic years of excess, absorbed inventory.

As Urbanation puts it,

With low-rise housing seemingly capped at 15,000 units per year going forward, a 20,000 unit gap is left for high-rise to fill. Based on historical trends, capacity constraints and construction progress to-date, it appears unlikely that many more than 20,000 condos per year will be completed over the next few years.

5. The Rental Market is Strong

I’ve talked about this many times over the last year on my blog so I won’t go into detail, but as long as the rental market continues to be strong and rents continue to rise, then why would there ever be a situation where thousands of condo investors dump their units? Why would I sell my unit at a $20-$50K loss when I can rent it out and break even while building equity? The process of buying real estate is often irrational – driven by emotion. But selling real estate is a much more logical dollars and sense decision. Don’t expect any fire sales any time soon.

Thanks for reading and special thanks to Urbanation, Realnet, and Ben Myers of Fortress Developments for their help with putting this blog post together.

If you like what you see, why not subscribe? It’s free.