How to be a Confident Condo Investor

Investing in real estate is not easy. If it was, everyone would it, but statistics show very few ever will. There are many voices inside and outside your head that will tell you that it’s not a good idea – here’s a simple tool to help deal with those voices and how to always increase your confidence as a condo investor.

Click Here for Interview Transcript

| Andrew la Fleur: | You’re crazy to invest in a new condo, that’s a horrible idea. Don’t you know that the condo market is going to crash? Has anyone ever said that to you? Are they right? We’ll find out if they are in What To Do About It in today’s episode. |

| Speaker 2: | Welcome to the True Condo’s Podcast, with Andrew la Fleur. The place to get the truth on the Toronto condo market, and condo investing in Toronto. |

| Andrew la Fleur: | Hi and welcome back to the show. You’re going to purchase a condo for investment, especially if it’s your first time purchasing a condo for investment you may encounter a lot of resistance. There may be some voices inside your heard, or outside your heard from yourself, or from people around you telling you that it is not a good idea. Telling you that you shouldn’t be doing it, telling you that it’s too risky, telling you that it’s a horrible idea, telling you that you’re crazy, telling you the condo market is going to crash, there’s a condo bubble, being a landlord is a horrible idea, et cetera, et cetera, et cetera. |

| This is normal when you are looking at purchasing your first condo for investment, or your first real estate investment, your first property for investment. It’s a normal thing that every first time investor encounters and goes through is when you start talking to people about it is you may hear some people say things like that to you. Why does this happen? Well usually it’s happening, you gotta look at the source. Usually the source, the people who are telling you this are A, first of all people who have never invested in real estate. If they had then the vast, vast majority of them would obviously encourage you to do the same because changes are they’d had mad a lot of money doing so. | |

| Really I think the root of it is just whenever we encounter something that we don’t know, or haven’t done ourselves, or are not familiar with, the natural human reaction just to be opposed to it. It’s sort of like whatever you’re not up on, you’re down on. This is just something I think is true about human nature, and something that we all encounter in not just in real estate investing but in every aspect of our lives whenever we’re trying to do something new. The fact is that making a first investment is a big deal. It’s a very big deal, it’s a very big moment in most peoples lives financially when they’re able to make that step. We have to remember that the vast, vast, vast majority of Canadians will never purchase a piece of investment real estate. | |

| This is something that very few people will ever actually do and go through, but the rewards obviously are significant, very significant. Really what it is, is it’s a breakthrough. You’re looking to make a breakthrough in your life financially. You’re looking to do something that you’ve never done before, looking to take the next step in your life, and in your future. As you’re looking to grow personally and financially, and to make progress moving forward, it’s not easy. It is something that’s difficult, and it is something that you will face resistance to do, and there will be people that will tell you that it’s a bad idea. | |

| I wanted to talk about that on this podcast and get a little bit into the mental aspects of investing in real estate, and what it takes to overcome those humps. Obviously today’s episode, I’m specifically talking to the first time investor, or somebody who is thinking about making that first purchase in real estate. Even if you have purchased properties before, I think it will be useful for you as well to remind yourself of some of the principles of how to overcome these sorts of thoughts, and these sorts of things that people will tell you. Also I just want to introduce a tool that’s been helpful to me, and that is sort of a universal tool that you can use in any aspect of your life. Not just in real estate, but it’s a tool that you can use to move forward in any area of your life that you need to make a breakthrough in. | |

| The tool is called the, “Four C’s.” This is really the solution to this problem that we’re talking about, the 4 C’s formula. It’s not my idea, it’s not something that I’ve created, it’s created by a guy by the name of Dan Sullivan who runs a company called, “Strategic Coach.” I’ll include a link to that in the show notes for this episode. Essentially Dan Sullivan is a coach for entrepreneurs, and self employed business people. He has been coaching for many decades, and I’ve had been a part of the program for many years in the past, I was part of it. I still follow along with Dan Sullivan and the Strategic Coach Program. | |

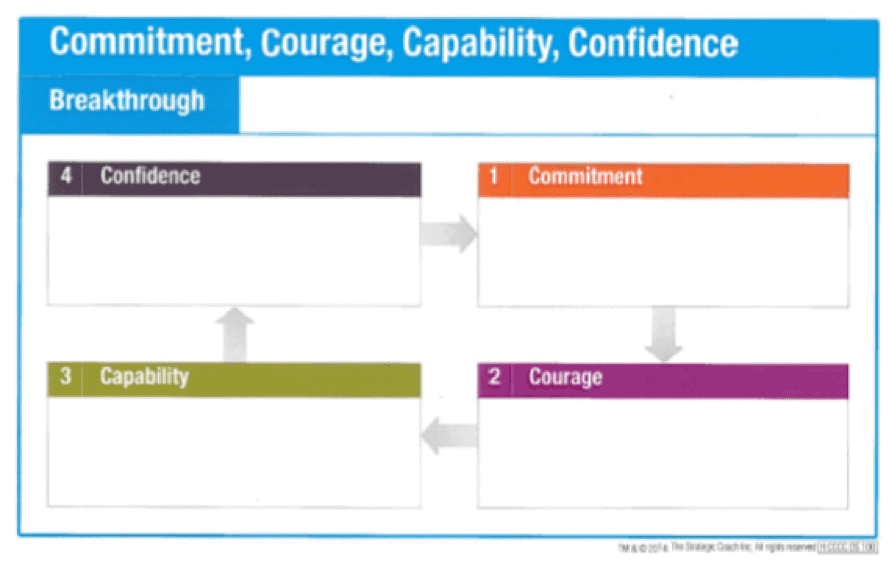

| One of the tools that is very foundational for this program and what Dan Sullivan has called the, “4 C’s.” Let’s go over that. First of all, what is the 4 C’s? The 4 C’s are basically four words, and a thinking tool to help you make a breakthrough. It sort of explains how every breakthrough happens in anyone’s life. Whether it’s personally, business, work, financially, relation-ally, any new skill that you learn. This is a way to explain how the breakthrough happens. The four C’s are commitment, is number 1. Courage, is number 2. Capability, is number 3. Confidence, is number 4. Commitment, courage, capability, and confidence. Again, I’ll include a link to this and maybe the diagram as well in the show notes for this episode, TrueCondos.com/Podcast to check out the show notes for this and all the episodes of the True Condo’s Podcast. | |

| That’s what it is, what does it do? Again, it helps explain and show how every breakthrough happens, and how progress takes place. How does it work? Well, it works a little bit like this. I’ll explain the C’s individually. Commitment, nothing starts until you commit to a specific result or a goal. In the case of real estate you must … investing, you must make a commitment in your mind that you’re going to do something. Something new, you’re mentally committing to doing it. The second thing is courage, the second C. Courage as Dan Sullivan says is, “The most crucial step,” it’s the most important piece of this whole thing is you need courage to take action. You’re doing something new, something hasn’t been done before, you’re facing resistance. | |

| If it was easy, everyone would do it. If it was easy, everyone would have these breakthrough’s in their lives all the time. They don’t, and most people never do. Why? It takes courage, and courage is hard. Things that take courage, it’s hard. You need to do something new, you’re taking a risk in some way, and you’re feeling some fears. There’s nothing wrong with feeling fear, it’s totally normal. I still feel fear every time that I purchase a new piece of real estate, I second guess myself, I wonder if I’m making the right decision or not. Even though I’ve done it many, many times over the past 10 years. | |

| The next C is capability. Commitment, courage, and capability. Once you have done something new, once you have taken that step, you’ve taken the action, you’ve utilized your courage to do something, you now have developed, whether you realized it or not, take a step back and realize that you have now developed a new capability. You are now able to do something new that you haven’t been able to do before. The last C is confidence. Confidence is sort of the amazing result of the process, and that as soon as you do it, as soon as you have that new capability in your arsenal of things that you can do or things that you have done or achieved, then you feel more confident. It’s only natural that your confidence increases, and your ability to do that thing again in the future, or to help other people do that thing, is now increased. | |

| That’s the four C’s, commitment, courage, capability, confidence. Now let’s take a look specifically, let’s walk through investing in a new condo. Specifically as you’re listening to this podcast, again you’re probably thinking about investing in a new condo or you have recently. Let’s apply it to investing in a new condo, the 4 C’s. The first C, commitment. What are you committed to? You are committed, you need to make the commitment to invest in a new condo. It sounds simple but that is actually the first thing that many people forget to do, and the first thing that sometimes I’ve found people, or meet people who say they’ve been thinking about investing in a condo for 1 year, 2 years, 3 years, 5 years. Some people think about doing it for honestly like 5 or 10 years. It’s because they never made that first step, that first step to a breakthrough is you need to mentally commit and tell yourself, and commit, that you are going to do it. | |

| Some people just think about doing it but they never actually say, “I am going to do this thing.” That’s the first thing, you need to say to yourself, like for example right now, “I’m going to purchase a condo this year. It is a goal that I am committed to doing.” Okay, good. You’ve done that, now the next step. Courage, again, the most crucial step of this whole thing is the courage part. Why does this take courage to do? Well because you’ve never don’t it before obviously, is the biggest thing is you’ve never done it. It’s something new, it’s something you’re not familiar with. Also again as I said at the intro of this podcast is there are voices out there, there are people telling you that it’s a bad idea. | |

| In my experience usually the people that tell you, that the loudest voices there are, usually the people closest to you. Your family, your close friends, they’re usually the ones who are the most … in some cases, not all, but in many cases they are the ones who are most, unfortunately likely to be there to tell you that, “It’s not a good idea, you shouldn’t do that, it’s too risky. What if this happens, what if that happens?” You have those voices in your head, causes fear. This is a normal reaction, or you just have internal struggles in your own head, thinking things through. “Is this a good idea or not for me?” You have to do the action. Fear is normal, but courage is sort of acting while you are afraid. That’s what courage is you could say. You need to take action despite the fact that you are not 100% totally clear. If it was easy, everyone had 100% clarity on this thing then everyone would do it. Of course we know that’s not the case. | |

| Once you have done it, once you have overcome the fear, which is a totally normal thing to feel, you now have developed a new capability. You have done it, you’ve invested in a new condo, you’ve taken the leap. The capability that you now have is that you now know how to invest in a condo. You now know what makes a good investment probably, you know things to look for in a condo, locations, to what makes a location a good location versus not. How to understand picking a good builder, picking a good unit. Understanding the financing aspects of it, understanding your strategy for renting it out, or selling it, or flipping it, and so on. You might not have learned all instantly over night, it’s a process over time. You having gone through it and done it, you now have a new capability. That’s the third C. | |

| The fourth C is confidence. Now that you’ve got this new capability, your mental state and how you feel about the whole thing changes right away. Once you’ve done it and you’ve gone through it, you instantly see things differently and everything feels better, and feels more familiar. You feel more confident, and you are now in a much better position to do it again. The fourth C in that sense are kind of a loop that continues. As you gain that new confidence, you are now much more … feeling better and feel more confident to make more commitments in the future. To do it again, or to do other new things, other breakthroughs again. | |

| That is how the 4 C’s would look, specifically with making your first condo investment. You might say, “Andrew, what about all those horror stories? What about all those people that have told me, or things that I’ve heard of second or third hand about the horrible bad experiences that people have had investing in new condo’s, or investing in real estate?” Well, it’s true. There are certainly horror stories out there, and not everyone has an amazing friction free massively profitable experience with real estate, and with condo’s, that is true. Let me ask you this, do you know someone or have you heard of people who have had a good experience, who have had a profitable experience? Who have made a lot of money investing in condo’s?” You probably have, otherwise you would not be listening this far into a podcast such as this. | |

| Obviously I am one of those people personally who have been having that great, great, great experience and made a lot of money investing in condo’s. If you don’t know anyone else, you know me. You know therefore that it is possible, it does work, it is a proven model. Someone, many people, many millions of people before you have made money in real estate, and being property landlord in real estate. What do you do with those horror stories? I think the best thing you can do with the horror stories is use it to focus your mind, and use it to know what to avoid, and what not to do. The mistakes that people have made before you, those are … that’s something to avoid, and the success path, the success that other people have had, such as myself, is the path to follow. Avoid the horror stories, follow the path to success and you’ll be fine. That’s what you can do with the horror stories is use them as fuel to focus your mind, and to know what things to avoid. | |

| That’s a wrap for today’s podcast, a little bit of a different format, a little bit of a different discussion. Hopefully you found that useful. Again like I said, this is not just applying to real estate, really any area of your life that you’re looking to make a breakthrough on, or if you look back and reflect, which is always something good to do is to look back on your year, or look back on the past few months, or the past season of your life, or your real estate, or your financial sort of career. Look back, and reflect, and say, “What breakthrough have I had in that period of time?” Sort of go through the exercise of how did that happen? How did it come about? What commitment did I make? Why did that take courage, and how did I do that? What new capability did I develop, and what new confidence do I now have moving forward? How can I … again, just repeat the process over and over. Over and over. | |

| Commitment, courage, capability, confidence. As you keep doing it over and over, and as you start thinking about things in that way, your confidence just continually grows and grows, and the breakthroughs that you make continue to get bigger and bigger. In the case of real estate investing, your net worth continues to get bigger and bigger. The types of properties that you purchase continue to get more and more profitable, and more and more bigger and bigger deals. There you go, the 4 C’s. That’s all I got to say about that. Hope you enjoyed that. Again, check out the show notes at TrueCondos.com/Podcast. I hope you enjoyed this, and have a great week. Until next time, bye for now. | |

| Speaker 2: | Thanks for listening to the True Condo’s Podcast. Remember, your positive reviews make a big difference to the show. To learn more about condo investing, become a true condo subscriber by visiting TrueCondos.com. |