Investing 101: The 4 Dimensions of Real Estate Investing

Disclaimer: this article is not meant to be considered taxation or legal advice. Always consult your appropriate legal and tax professionals for advice on such matters.

One of the reasons why real estate is such a powerful wealth creator is that, unlike other types of investment, it allows for multiple income streams and has some powerful tax advantages at the same time.

Real estate investing actually has 4 fundamental dimensions that all contribute to your ROI (return on investment).

Cashflow

Rental properties produce cashflow. This is the first dimension of real estate investing.

Cashflow is the profit (or loss) that is left over every month or every year after you have taken the rent you have received and paid your expenses (mortgage payment, property taxes, management/condo/HOA fees, insurance etc.)

You will not get rich off of cash flow alone, but you will always be able to sleep at night if you know that you’re making money every month and your tenants are paying all your expenses and more on a property.

Cashflow is the foundation of all real estate investing, but it is not the only aspect that makes real estate the most effective asset class for wealth creation.

[content_box box_type=”confirm” title=”TIP”]The rule of thumb when it comes to cash flow is that every property should be cashflow positive (that is, the monthly rent is greater than the monthly expenses) with 20-25% down. Never buy a negative cash flowing property.[/content_box]

Principal Pay Down

The second dimension of real estate investing is principal pay down.

This is a like a secret wealth generator, working behind the scenes constantly to make you rich.

When you are a real estate investor, you are outsourcing your debt obligations by having your tenants pay your mortgage for you. And part of the mortgage payment is going directly to principle pay down which adds to your net worth every single month.

[content_box box_type=”confirm” title=”TIP”]The best part about principle pay down is that it actually accelerates over time, rewarding the patient and long term investors. Always plan to buy real estate for the long term.[/content_box]

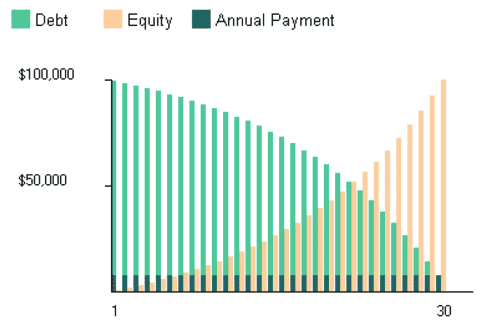

Look at this typical mortgage graph.

You can see that over the life of the mortgage, the interest portion (debt) of the mortgage payments start high, then decrease. And the principal portion (equity) of the mortgage payments do the reverse.

They don’t move in a straight line. They accelerate (principal) and decelerate (interest) over the full term of the mortgage.

The longer you hold a property, the more you can take advantage of principal pay down and growth of your net worth through equity.

Appreciation

Buy low, sell high.

This is a simple concept that everyone can understand and this is the idea behind appreciation.

However, I list appreciation as the 3rd dimension on purpose.

Capital appreciation is like the icing on the cake – it’s nice to have, but not something you should count on or plan for.

Real estate markets move in cycles and have ups and downs, as long as you have a cashflow producing asset then you are safe and protected and you don’t have to worry year in and year out if your property has gone up or gone down in value on paper – you’re making money either way.

Too many investors (or wannabe investors) think that real estate is a get-rich-quick type of scheme where you simply buy low one year and sell high the next.

This type of mindset is dangerous and highly risky.

The reality is that real wealth is created in real estate by taking the long term view and holding properties for decades, not flipping properties every couple years.

With all that being said, we have about 5000 years of human history to clearly demonstrate that over time, real estate values do tend to go up.

In Toronto especially, we have enjoyed a very nice steady run since about 1996 where values have gone up nearly every single year at an average of about 5-6%.

[content_box box_type=”confirm” title=”TIP”]Don’t buy just for appreciation, but the best way to ensure you enjoy some appreciation on your properties is to buy below market value whenever possible.[/content_box]

Depreciation

The final dimension of real estate investing is something called depreciation.

Now hold on, you might be saying, how can you benefit from appreciation and depreciation??

Let me explain…and this is really part of the beauty and the power of real estate as an investment class!

The CRA (or the IRS in the United States) allows you to depreciate the value of your property (not including land value) against the income that it generates.

This is also called the Capital Cost Allowance or CCA.

This is a write-off that you do not actually pay for.

For many investors (but not all, consult your tax professional) this gives you a powerful tax deferral or potentially tax reduction tool.

Perplexingly, many people avoid investing in real estate because they do not want to have to pay taxes on the income. This makes no sense!

That said, CCA allows many investors to effectively reduce their annual income on a rental property to zero, meaning you pay no taxes.

If you are paying taxes on income, this means that you are making a profit! Not taking action on an investment because you fear paying taxes on the profits is a dangerously stupid mindset.

It is important to note that the CCA is a double-edged sword in the sense that if you do elect to claim the CCA on a year to year basis, you are required to add the amount claimed back to the selling price in the event you sell the property.

This increases your profit on a sale, which would increase your tax payable.

So it allows you to not pay any taxes today, but you will have to pay taxes later. Depending on your tax bracket and other considerations, the CCA may or may not make sense for you.

[content_box box_type=”confirm” title=”TIP”]Using depreciation to offset your income on rental properties is not mandatory but it can be a powerful tax deferral or reduction tool for many investors.[/content_box]