Why Toronto is a Superstar City and What it Means for Condo Investors

Richard Florida, noted urbanist and author, says that Toronto is in a class of “superstar cities”. Find out what this means and why it’s great news for condo investors as Andrew la Fleur analyzes a recent article in the Globe and Mail that talks about home ownership rates in Canada and the effect of rising real estate prices.

EPISODE HIGHLIGHTS

1:23 Article’s interesting point: about home ownership rates in Canada.

3:10 Core value of our society that people own a home.

4:30 One of the justifications for high house prices in Toronto.

5:45 Households in superstar cities rent more than they own.

7:49 Sales transactions going back 50 years for 3 houses in the city.

8:00 Shift away from working class owners to professionals and executives.

10:23 The latest numbers from Urban Nation and other sources look at the rent.

Click Here for Episode Transcript

| Andrew la Fleur: | Urban studies guru Richard Florida says that Toronto is in a class of cities known as superstar cities. Find out why, and what it means for Toronto condo investors on today’s episode. |

| Speaker 2: | Welcome to the True Condos podcast, with Andrew la Fleur. The place to get the truth on the Toronto condo market and condo investing in Toronto. |

| Andrew la Fleur: | Hi and welcome back to the show. On today’s episode I’m going to be looking at an article that was just posted this week in the Global Mail by Rob Kerrick. The headline is, why do Canada’s renters get such a bad rep? There’s some interesting points in here about the Toronto housing market, and ownership and rental rates. We’re going to talk a little about Richard Florida, the urbanist and author has to say about Toronto as well. Just going to read some quotes here from sections from the article and of course I’ll include a link to the article and the show notes for today’s episode. You can get the show notes for this episode and all the episodes of the True Condos podcast at TrueCondos.com/podcast. |

| The article has some interesting points. It talks about home ownership rates in Canada and how especially in Toronto, we’re heading to the thesis is we’re heading to lower home ownership rates as prices continue to get out of reach for more people. The ownership rate will presumably go down, and there’ll be more renters, which of course is always good news for condo and property investors. | |

| Let’s take a look at the article. It says Canada’s home ownership rate was 69% in the latest national household survey from statistics Canada from 2011. This was up from just around 60% in 1971. It’s one of the highest rates of home ownership in the world among major industrialized countries. The United States recently clocked in at 63.5%, I’m just going to stop right there. United States, 63.5% home ownership versus Canada, 69%. The US rate is a little bit deceiving because it was probably around 69-70% also a few years back, before the housing collapse in the US. That number, it seems quite a bit lower than Canada, but that number is climbing and it will in a few years probably be back closer to that 70% mark. Right now, there’s a pretty big gap between the US and Canada. | |

| Article goes on to say Britain and France have been around the area of around 65%. Germany, a noted renter’s market, is only at about 53%. The article goes on to say the core value of our society that people own a home, that’s why government has massively indebted the province of Ontario- sorry- that’s why the government of the massively indebted province of Ontario, excuse me, just doubled a tax break for first-time home buyers. There’s no getting around the fact that as house prices climb, the home ownership rate will fall. The result is more renters. Obviously the crux of this article here is talking about how the fact that as house prices keep going up, especially in cities like Toronto and Vancouver, more and more people will just not be able to afford to buy a house. | |

| This is something we talked a lot about in the podcasts, and it’s just a fact that as this city continues to mature, and as we turn more and more into so many of those global cities that we’re always compared with, New York, London, and other cities like that, you look at those cities and home ownership rates is much lower, are much lower. It’s just much more common to rent in those cities than it is to own, simply because you can’t afford to purchase anything. That is the direction, the trajectory of Toronto as we are expected to add about a million people to the city over the next decade. | |

| One of the justifications for the article goes on to say, one of the justifications for high house prices in Toronto and Vancouver is that they are what urban studies guru Richard Florida calls superstar cities. Superstar cities, by the way, if you are on Twitter, highly recommend that you follow Richard Florida on Twitter. He’s a great guy to follow about any urban related issues. He is an American, but he is based here out of University of Toronto, has been for several years, and he talks a lot about Canadian and Toronto-related urban issues. A side note, yes, I have tried to get him, asked him, offered several times to have him on the podcast here for an interview. We haven’t lined up our schedules yet to make something work out, but Richard, if you’re listening, you are welcome to come on the podcast anytime. | |

| The article goes on to say these superstar cities, they draw in people and capital from around the world, and thus have the economic fundamentals to justify expensive houses. Households in superstar cities rent more than they own. An article Mr. Florida wrote earlier this year talks about the rise of renting in big cities and tech hubs. Renters accounted for almost 57% of households in New York, and around 54% in Los Angeles and San Francisco. The ownership rates in Toronto and Vancouver were around 68 and 65%, respectively, according again to the 2011 data, which is the most recent data that we have. | |

| Major differences still in rental and ownership, the ratio of rental to ownership in Toronto and Vancouver compared to cities like New York and Los Angeles, San Francisco, but the point being again as Richard Florida’s pointing out, that this is common in these superstar cities, cities that attract talent and people from around the world, money and investment from around the world, capital from around the world. They just have this class of people that drive real estate prices up, it’s a very professional affluent base. It just, it turns into a city where most people rent because that’s the only thing that you can afford, and that unfortunately, for better or for worse, that is the direction that Toronto is heading. Again, as condo investors, we need to understand that, study that, analyze the market from that perspective, and know that again, 10-15 years from now, we may look back and say wow, I can’t believe that we used to have ownership rates in Toronto of 68-70%. Those rates could come down dramatically over the next 10 years as prices continue to rise. | |

| Read the whole article, but just finish up with a couple other sections here. It goes on to say Toronto Life magazine recently ran an interesting feature, which it looked at sales transactions going back 50 years for 3 houses in the city. Prices soared, of course, but the more important story is the shift away from working class owners to professionals and executives. Shift away from working class owners to professionals and executives, again, this is the evolution of the city. You look at a lot of the neighborhoods, of course, in the core of the city, they’re historically working class neighborhoods. Very blue collar sort of neighborhoods, but now it’s who’s buying real estate today, who’s moving into these core neighborhoods in the city, who’s driving up real estate prices in the core of the city, it’s professionals, it’s executives, it’s entrepreneurs, it’s business people, it’s wealthy immigrants. There’s just a lot of money coming into the city, particularly the core, and the city is changing. The city is changing from a working class blue collar sort of slanted manufacturing-based city to a more professional, affluent, you know, economically speaking, very different city than it was before. | |

| This is something that is happening at many cities across the globe as the global economy is changing and favoring these superstar cities. Article goes on to say even as rents rise in cities with strong real estate markets, the total cost of a combination is a lot lower than owning a house if you’re a renter, he’s saying. Well, I don’t know if I would agree with that. I know Rob Kerrick, the author of the article is a big proponent of renting over owning, or at least he’s a big defender of renting over owning. I don’t know if he’s necessarily saying everyone should do it, but he’s written a lot of articles over the years about that. | |

| If you’re actually looking at properties today, buying versus renting them, again, there’s a bit of a misconception out there that well, if you just rent it’d be a lot cheaper. I suppose it’s a lot cheaper if you only have like a 5% down payment or something, but you’re comparing a 20% down payment and the cost associated with that versus renting the same property, most of the time you’re going to find it’s cheaper or the same to own that property rather than to rent it, especially given the fact that rental rates have been increasing. The latest numbers from Urban Nation and other sources look at the rent’s increasing at about 10% year over year. Rental rates have increased significantly and have in fact caught up with the rising property costs as well. | |

| There you go, that’s the article. I’ll include a link to this in the show notes. Again, the main take aways from this is that Toronto is a world class city, it’s a superstar city as Richard Florida calls it. We are going to see decreasing ownership rates, that is a trend to watch in our city. As ownership rates decreases, the rental share will increase. It’s good news for us as condo investors, more and more renters are going to be coming down the pipeline in the years to come. Thank you very much for listening once again, and until next time, we’ll talk to you soon. | |

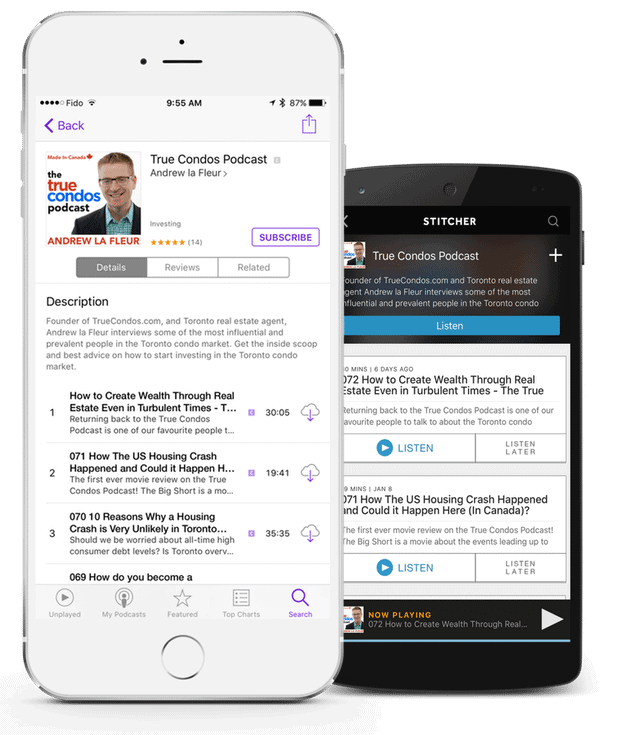

| Speaker 2: | Thanks for listening to the True Condos podcast. Remember, your positive reviews make a big difference to the show. To learn more about condo investing, become a True Condo subscriber by visiting TrueCondos.com. |