Why Every Investor Should Own A Studio In Regent Park

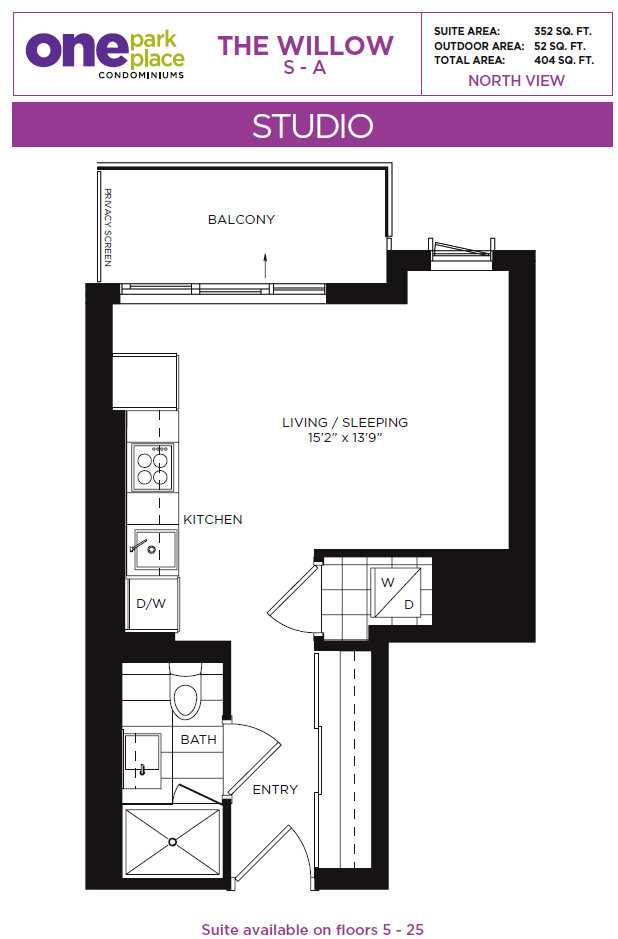

Example of a near perfect studio floor plan in One Park Place

It’s no secret that I own a studio in Regent Park. In fact, it’s affectionately become known as “The Smallest Condo in Toronto“. At just 301 square feet, there’s nothing like it in Toronto. I bought that unit back in 2010. I took occupancy of it in 2011, and I’ve rented it out for the past year. I’ve enjoyed positive cash flow on that unit for the past 13 months while at the same time the tenant has been paying down my principle on my mortgage. I bought it for about $165K and it was recently appraised at $210K. My only regret with that unit is that I only bought one. I wish I had bought more!

I believe so strongly in this type of investment property that I’m calling this blog post “Why Every Investor Should Own A Studio in Regent Park”. If you are a condo investor, you should seriously look at adding a studio in Regent Park in your portfolio.

One Park Place is the latest new condo building to launch in Regent Park. They had the very first sales event last weekend. I was there and several of my clients were able to get great investment properties in the building. They sold approximately 70% of the building and more units were actually sold than what they did 1 year ago at Paintbox condos (the last building to launch in Regent Park).

This, despite the pundits telling us that the sky is falling and it’s a bad time to invest in a condo. This is the 4th building in a row in Regent Park that has nearly sold out on opening day.

Now, I know there are some common objections that you might be thinking about already with respect to this, so I thought I’d address the 3 most common myths I encounter when talking to investors about studios in Regent Park.

Myth #1: Studios are not good for investment

I don’t know why this myth is such a popular one, because it is simply not true. Studios make excellent investment properties and they always will be.

The rent:price ratio for studios is generally better than that of 1 bedrooms and 2 bedrooms. This usually translates into a healthy cap rate.

The cost of living in Toronto keeps going up and up each year. More and more new people are coming to Toronto every year. Being able to charge less than all your competitors while still covering your costs is exactly where you want to be as a landlord.

Studios allow you to do this (and especially studios in emerging neighbourhoods where you can charge slightly less than the downtown average for studios). Case in point: the downtown average for studios is now about $1400/month while in Regent Park it’s about $1250/month.

Myth #2: Regent Park is a terrible place to invest.

This one is similar to the “Regent Park is a ghetto” myth. Far from the truth. We can debate all day long about whether or not Regent Park is a good place to live, but for the type of investment I’m advocating, it’s a no-brainer.

Yes, everyone knows Regent Park has had a shady history, but as a real estate investor, the past should be completely irrelevant to you-any money you will ever make from this day forward will be in the future, not the past!

This is the largest urban revitalization project in North America. We are about 4 years into a 15 year plan for this neighbourhood. When it’s all said and done Regent Park will be a vibrant and healthy neighbourhood in the heart of downtown Toronto.

There are so many reasons why it’s foolish to ignore investment opportunities in this neighbourhood because of it’s past history, but let’s just look at two.

First, the numbers don’t lie. Check this example out:

Purchase price: $209,900 (for the 19th floor of the floor plan at the top of this blog post)

Down payment required: 20%

Once you do that, the monthly cash flow looks like this:

$706 = mortgage payment (mtg amount $167,920, 3% fixed rate, amortized over 30 years)

$204 = maintenance fees

$100 = property taxes

$17 = condo insurance

= $1027/month total expenses

Current Market Rate for Rental For This Property:

=$1300/month

$1300 (rent) – $1027 (expenses)

= $273/month Positive Cash Flow

= 5.6% Cap Rate

Try doing that with a studio on King West or near Yonge street-I can tell you it’s not going to happen. You will rent it out for slightly higher on average but you will pay $30-100K more for the property thereby killing your cash flow and cap rate!

Second, you are buying from one of the best builders in the business and the quality of construction and finish in the buildings of Regent Park is better than most of the product downtown that buyers are paying upwards of $700 per square foot for! You will be impressed by Daniels’ quality and service.

Myth #3: Renting out a studio will mean I will have to put up with low quality tenants

This is a pervasive one that keeps many people from investing in studios. The fact of the matter is, there is nothing unique about studios that determines whether or not you will get a bad tenant.

Bad tenants exist across all properties and all price points. Just because you have money, doesn’t mean you have common sense or manners!

No matter if you are renting a studio for $900/month in Scarborough or a penthouse at the Ritz Carlton for $10,000/month, there will always be some ‘bad apple’ tenants that could make your life miserable. Having more or less money does not make a tenant better or worse.

Screening up front is key to finding a good tenant but there are no guarantees in this business. Real estate investing is not for the faint of heart!

I can tell you from my own experience with renting studios over the years for myself and for my investor clients that I’ve never had a problem with this type of tenant. In fact, most of them are young, just starting their careers and they are hard working people with big dreams and bright futures ahead. There is none of that sense of entitlement that sometimes can come with people who feel that they ‘have arrived’ and want the world to serve them!

Ok, enough with the myth-busting.

Here are 4 reasons why these studios are such a great investment, and why you should buy one today if you are an investor.

1. Perfect Investment Unit

Clients always ask me, “what is the best unit to buy for investment?”

There are a number of ways to answer that question, but the best and most simple answer is to always buy the smallest unit of any given type. The Willow unit is the smallest studio at One Park Place.

This means your purchase price, carrying costs, maintenance fees, etc are all LOWER than all your competitors in the building, BUT you can typically charge the same rent as everyone else.

In other words, a studio is a studio. (A 1 bedroom is a 1 bedroom etc.)

Whether it’s 300 sq ft or 465 sq ft, it’s still a studio and the utility to a tenant is the same, therefore they will tend to pay the same rent regardless of small differences in size. Studios in general are the easiest units to find tenants for because of price point.

$273/month on a studio AND a cap rate of around 5.6% makes this a perfect “buy and hold” type investment.

2. I Bought One (Actually, Two) Already

As I mentioned, I already own a studio in Regent Park.

I’ve been renting it out to a young professional and enjoying positive cash flow from day one. My only regret with that unit was that I didn’t buy more than one!

Well, now I’m buying a second studio in One Park Place to add to my investment portfolio. So I’m putting my money where my mouth is-times two.

3. No HST Headaches!

As the government continues to make it more and more difficult to make money as a real estate investor, we need to stay ahead of the curve.

The HST is becoming a real problem for condo investors in this city (even though most investors, agents, and even lawyers are completely oblivious to it).

Basically, if you are buying a condo that is priced above $350K, you need to know that you might have extra HST costs that will affect your bottom line as an investor.

Because this studio is such a low price, and no where near $350K threshold, you will not have any worries about whether or not you will be able to get your HST rebates back.

Read all about my pain-free experience in dealing with the HST rebate system.

4. Best Deposit Structure in the City

You can buy this studio with only 5% deposit and it won’t be finished for another year and a half. That means you have about 18 months to invest (if you have the money) or save up (if you don’t) your remaining 15% that will be required on final closing since it is an investment property.

Not only that, you can actually pay the 5% slowly over the next year! You have the option of paying just $3500 up front, then $1000/month until you hit 5% deposit.

I’ve been in this business a long time and I can tell you this is the easiest and most manageable deposit structure for a brand new condo I’ve ever seen.

For more information on how you can buy a studio (or similar) in Regent Park, please sign up below.