Something I never thought would happen just did

Andrew la Fleur is constantly tracking the condo market, looking for trends and spotting opportunities in the data to help condo investors make strategic investments. Recently he has spotted something he says he never thought would happen. Find out what it is and why it represents a huge BUY signal for downtown condo investors.

EPISODE HIGHLIGHTS

1:30 One stat the i look at to understand the direction and temperature of the market.

2:25 The housing market has always been hot.

2:50 Condo market has been strong.

5:00 The average for detached housing.

6:10 Condo prices are gonna keep rising.

9:58 Looking at sales to listings ratio for detached houses.

11:40 On the flip side on the housing market.

12:55 Massive inventory increase.

13:34 Major recession.

13:49 If buyers switch back to houses.

14:58 Conclusion.

Click Here for Episode Transcript

Andrew la Fleur: Something I never thought would happen actually did in the Toronto real estate market. Find out what that is on today’s episode.

Announcer: Welcome to the True Condo’s Podcast with Andrew la Fleur, the place to get the truth on the Toronto condo market and condo investing in Toronto.

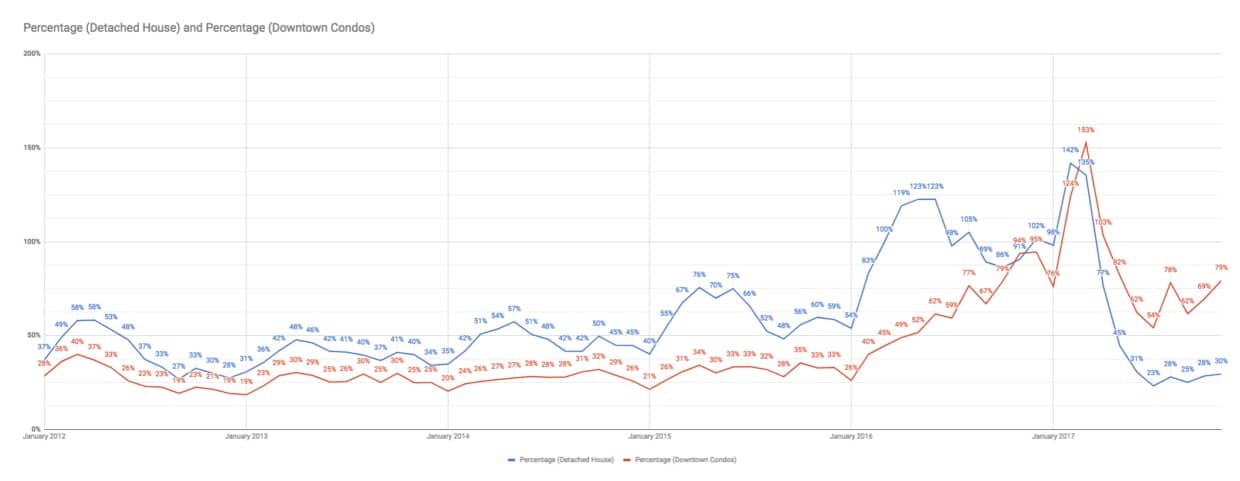

Andrew la Fleur: Hi, and welcome back to this show. Thanks for listening. Andrew la Fleur here, once again, and today, we’re talking about statistics numbers. I’ve been looking at this chart that I had my team put together for me all day, and I’m just, I can’t believe what I’m looking at. I just had to share this with you.

You definitely want to go ahead and get a visual on this chart. You can listen to this podcast, but it’s going to work much better if you have the visual in front of you as well, so if you want to head on over to truecondos.com/podcast and pull up this episode and the show notes there, and you’ll have an image there with the chart that I’m talking about.

This chart in question is a chart I got my team, as I said, to put together. It’s basically looking at the last several years, and it’s comparing the sales-to-listing ratio for GTA detached houses and the downtown condo market, so downtown condo market versus GTA detached houses and looking at the sales-to-listing ratio.

As I talk about all the time in the podcast, when I’m looking at the market, the one stat that I look at more than any other to understand the direction of the market and the temperature of the market is the sales-to-listing ratio. The sales-to-listing ratio will tell you more, I believe, than anything else.

Another way of speaking about the sales-to-listing ratio or expressing this ratio is through months of inventory. Months of inventory is another way of looking at it, but I prefer the percentage way. It’s a little bit more, I don’t know. It just, it works with me better, but you might look at it as the months of inventory as well. Looking at the sales-to-listing ratio for these two markets over the past several years, going back from the start of 2012 until today, basically, the housing market as we know, low-rise housing in the GTA has been hot forever, basically. It’s always been a hot market. Finding a detached house in particular has always been a difficult task, and bidding wars have been common on that type of property in all across the GTA forever.

On the other hand, condos, although the condo market has been strong, although the condo market is growing, although prices are rising and rents are rising and everything else, relative to the detached, low-rise housing market, it has not been as strong. Well, until recently, that is. Again, this is what I’m getting to, and this is the thing that I never thought would happen has actually happened in our market. It’s actually happened several months ago, but I guess it took, I wanted to see if this trend would hold up, and it has been holding up for going on, I guess, one, two, three, four, five, going on for six or seven months here. This is not a blip. It’s definitely the new reality in the market right now. Is it going to hold up or not, I don’t know, but what I’m talking about is the fact that the sales-to-listing ratio for the downtown condo market is now higher than the sales-to-listing ratio for detached houses in the GTA.

Another way of saying this is that the condo market is a hotter market, a much hotter market than the detached housing market, and this has never been the case. This is a new phenomena we’ve never seen before. The detached housing market has always been at a higher fever pitch compared to the downtown condo market.

Again, the downtown condo market has been doing very well. Been enjoying great returns for our investors in this segment for many years and doing very well, but the low-rise housing market, there’s always been this shortage of supply and this abundance of demand, and bidding wars and everything have been extremely common in the low-rise, detached market and not as common in the condo market.

Historically speaking, if you look at this chart, the gap between them, so the sales-to-listing ratio, the average for the past several years, it’s been about 20% higher, so 20% higher, whatever the sales-to-listing ratio is, the average for detached housing has been about 20% higher than the sales-to-listing ratio for the downtown condo market, but now, over the past several months, it’s completely inversed. It’s not that it’s leveled out or matched up. It’s actually completed inversed where the condo market, sales-to-listing ratio, is not 20% higher than the detached housing, but it’s about 40-50% higher for the past six months or so. 40-50%, which is just an unbelievable reversal.

Nobody really could’ve predicted this, certainly not a year ago. Nobody would’ve seen this coming that there’d be such a dramatic shift. This is just, it’s absolutely incredible to watch this shift that’s happened in the market and to speculate and to strategize based on it and what we can expect as condo investors.

A few thoughts on this. Number one, the most important thought is that condo prices are going to keep rising. You’re going to see more and more headlines coming out. We’ve seen a lot of them, obviously, lately about the real estate market is cooling, housing is cooling, things are slowing down, numbers are way down and so on, but again, this is not what’s happening in the condo market, and in particular, the downtown condo market, which is what we’re most interested in and most concerned about as condo investors.

With the sales-to-listing ratio now for the past six months in the downtown condo market hovering between 60 and 80% range, that is incredibly high, and that indicates that prices are going to continue to rise. If you look at, historically, over the past five or ten years, prices were rising for downtown condos in the 3-5% per year range. That was attached to a typical sales-to-listing ratio of around 30-40%, so 30-40%, that was a normal range. Even lower, 25-40%, that range was typical for the downtown condo market. Even with that low, low number, you were still seeing prices rising in the 3-5% range, which is a very healthy market, and if you’re a condo investor and holding on to a condo for five or ten years, and if it averages 3-5% increase per year, you’re going to get phenomenal returns on your investment overall because of leverage, because of your cash flow, mortgage paydown, and all the other aspects of the investment. You’re going to be getting double-digit returns for sure if you’re holding that asset and it’s averaging 3-5% appreciation.

Now, in the last couple of years, 2016, 2017, of course, the market has heated up significantly, and we’ve seen, well, for example, in 2016 where the average sales-to-listing ratio was, instead of 25-40% range, it’s creeping up into 40-80% range, so in that 40-80% range, we saw prices rise significantly into the double digits, and then in the first few months of 2017, which was the fever pitch, the highest point of the market, we saw that sales-to-listing ratio actually soar above 100%, which is unbelievable. It peaked out at 153% in march of this year, 153%, which is, again, unprecedented. That was when we were seeing prices rising and the headlines were coming out, that 30%, 35% price increases.

Now, today, again, we’re back down in the 60, 70, 80% range, which is still double, more than double what the normal historical level has been where we saw those 3-5% price increases. All this to say with the sales-to-listing ratio for downtown condos so high, we can definitely 100% expect prices are going to continue to rise. They’re going to continue to rise in the double-digital range, 10-20% on the low case with this sort of a market, expect prices to go up 10% annualized, and in the high case, you can expect prices to go up as much as 20% annualized with this sort of a sales-to-listing ratio.

On the other hand, looking at houses, detached housing, which is definitely struggling right now, they’re sitting in the 20s, the high 20s percent range for sales-to-listing ratio, which is pretty much exactly where the condo market was for many years. Normally, with that sales-to-listing ratio, you would expect prices to rise at a similar level, 3-5% range, but given the heights at which the detached houses has fallen, I’m expecting house prices to basically be flat in the months and the year ahead. You can expect house prices to remain fairly flat, maybe slightly up a couple of percentage, maybe slightly down a couple of percentage, but the momentum is definitely pushing it down, and the sentiment out there is definitely pushing it down compared to the downtown condo market.

What’s causing all this? What is driving this unbelievable surge in the condo market, and on the other side, the unbelievable change and slowdown in the detached housing market? Well, in the condo side, you’re looking at low inventory, very low inventory, the amount of units available for sale. The supply side of the equation is very, very low compared to what it has been, and you’re seeing also continued growth in sales. The overall trend in sales is continued, manageable, slower, but positive growth in the actual sales side, but the biggest factor, if I was picking one, would definitely be inventory supply. Supply is way down.

On the flip side, when you’re talking about the housing market, why is that market so slow right now? It’s a double-whammy of very high inventory. The supply side has soared dramatically from what it was to all-time highs, which we haven’t seen before, and the number of sales, although still strong relative to years past, is down significantly from what it was in the peak of the market 6 months, 12 months, 14, 16 months ago. Sales down, inventory way up, but again, the story is really the inventory is really driving it.

Specifically talking about the condo market and the fact that I am expecting prices to continue to rise in double digits in the months ahead, the question that people are asking me is what could stop this run, what could change this trajectory? I mean, obviously, it’s a great time to buy a condo right now because you’re basically guaranteed that that condo is going to go up by double digits in the next year ahead, unless there’s some dramatic change to the market. What could be a dramatic change to the market that might affect this?

Well, number one is if we see some kind of a massive inventory increase. If we do see a huge amount of new supply coming on to the market, that would obviously affect the supply-and-demand equation and bring that sales-to-listing ratio down to more historical levels. I don’t anticipate that happening. I don’t see how that could happen. I don’t see a massive sell-off of condos happening any time soon, especially since, again, prices are rising and people are still buying and there’s still a relatively, certainly affordable compared to purchasing a detached house.

The other thing that could stop this run, obviously, and something that’s always true is a recession. If there’s some kind of a major recession or major economic shock to the economy overall, that certainly could have an effect on things. Again, it’s not something that anybody is anticipating at this point.

The third thing is, if buyers switch back into houses. The buyers that have been priced out of the housing market and they’re now buying condos like crazy, if those buyers, if condo prices continue to rise and house prices continue to be flat, the gap in price in between those two property types shrinks, at some point, the buyers will switch back, so to speak, to buying houses. If the demand shifts over and the market overall more towards houses and moving away from condos, then we may see the condo market cooling down, and we may see the housing market heating up.

At some point, this, in 2018, perhaps, that shift could start to take place as well, but again, it would have to be something incredibly dramatic for the overall trajectory of the condo market to change, that is, the trajectory right now is straight up. Even if the market cooled down, it’s still going up. It might just return to more historical norms that we’re used to.

There you have it. I hope you enjoyed this episode. Just in conclusion, definitely keep buying condos. If you have condos, don’t sell them, hold on to them. They are going to continue to appreciate. If you’re hearing headlines about the real estate market slowing, does not apply to the condo market, especially the downtown condo markets, so hold on to those condos if you got them. If you don’t, make sure you’re buying them, and if you already have them as well, keep adding to your portfolio right now. I know I’m certainly always looking to add to my portfolio.

I haven’t bought anything in a few months now. Looking to add something soon. I’m almost at that point where I’m read to jump back into the market myself, looking for and getting ready for that opportunity. I’m almost financially there again after making some big purchases earlier in 2017.

Finally, stay away from houses. If you’re looking for investment, I would say stay away from houses for now, detached housing. The market there is very flat. The pressure is down. At some point in 2018, that will probably change. I would think it’s going to happen in 2018, but we’ll have to see how the market goes and see, again, watch that sales-to-listing ratio. That’s going to be our key indicator that we’re watching every month to see what’s happening in the market.

Until next time, I hope you enjoyed this, and happy investing.

Announcer: Thanks for listening to the True Condos Podcast. Remember, your positive reviews make a big difference to the show. To learn more about condo investing, become a True Condo subscriber by visiting truecondos.com.