More Hard Times Ahead For the Ultra Luxury Market?

One year ago I wrote a couple posts about some of the warning signs that all was not well in the “ultra luxury” segment of the condo market. You can see the posts here and here. Sales prices were not what investors were expecting, inventory was growing and prices were showing signs of weakness. Today, Shangri-La now a registered building and Trump Tower should be finished soon. Can we expect more hard times ahead for the ultra luxury market?

The kitchens in the suites at The Ritz are spectacular.

What’s Happening Now at The Ritz Carlton?

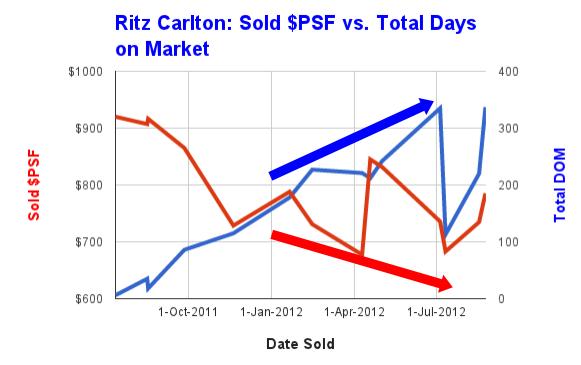

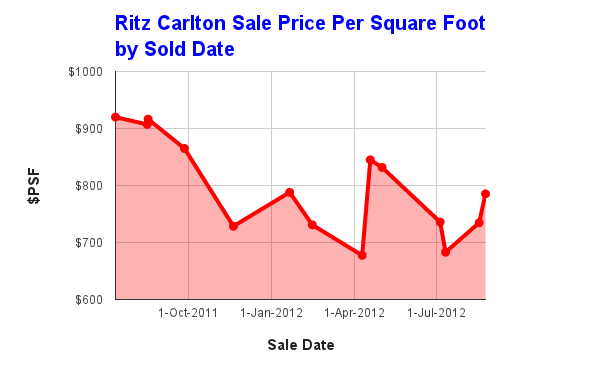

More than a year after the Ritz Carlton has been completed, and the dust looks like it is starting to settle. You can see in the chart below that prices are starting to find their level at around $750 per square foot. The average price for all MLS sales since the Ritz was registered in July 2011 is $796PSF. To those who sold at the very beginning for over $900PSF – CONGRATS! You outperformed your peers by a long shot. The Ritz is still an incredible bargain by international standards, or even by local standards when you compare it to Yorkville prices or other high end buildings anywhere in the city.

In terms of inventory, on the MLS right now there are 18 available units at The Ritz, with 2 sales in the last 60 days, meaning there is about 18 months of inventory – not great, but better than the 30 months of inventory when I looked at this building last year at this time. The big mystery remains – how many units does the developer still have that are NOT on the MLS? I have no idea the answer to this question. I’ve heard different rumors but until I have some facts I won’t comment on that. The average days on the market for all sales so far at the Ritz is 167. The average time it takes to sell an average condo downtown over the last year is more like 30 days.

Combining the last two charts you quickly see the trend that has taken place at The Ritz over the last year:

Finally on the Ritz, one very interesting stat: the average sale price of units that have sold is 94% of the asking price (downtown average is more like 98%). But more interesting is when you calculate the selling price as a percentage of the original list price (most suites have had several price reductions before selling), that number is actually a shocking 82%. In other words, a year ago, everyone assumed that they would be selling their units for well in excess of $1000PSF, but now today we know that is not true.

Here Comes Shangri-La…

Shangri-La is now registered after only 3 months of occupancy. This is a tremendous feat by the developer to get their building registered so quickly when other buildings can languish for 6-12 months or more in limbo while waiting for registration.

Currently there are 18 units on the MLS, with 6 of them being from the developer’s remaining inventory. (The developer still has more units available that are not on the MLS). Nothing has sold yet as a resale. It will be very interesting to see what $PSF they get at Shangri-La compared to the Ritz. Probably the first units to sell will be the smaller units in the lower floors that are priced around $900PSF and have the lower maintenance fees, but time will tell.

Penthouse View at Shangri-La

…And Trump is Right Around the Corner

Trump Tower is still not registered, from those I’ve talked to no date is on the horizon quite yet. Definitely this one is the slowest of the bunch to get completed but so far it’s nothing but rave reviews for the quality of the building itself and the restaurants, the hotel etc. First class all the way.

Have you been to Stock restaurant at Trump yet? It’s really, really good.

Who Will be King?

One thing is certain, all three buildings are spectacular and unlike anything else in Toronto. The restaurants and hotels at all three are packed on a daily basis from everything that I’ve seen and heard. The big question we hopefully will get an answer to in 2013 is who is going to be the king of the 3 ultra luxury towers in the core (Four Seasons in Yorkville is a separate beast)? Who will command the highest price per square foot moving forward? Will it be the Ritz, Trump, or Shangri-La? It’s not possible to comment on Trump because it’s not finished yet. Comparing the residences at the Ritz and Shangri-La, I see four significant differences that Shangri-La has compared to the Ritz:

1. Balconies. Many units have balconies at Shangri-La, whereas virtually none of the units at The Ritz have them.

2. Direct Garage Access. One strange thing about the Ritz design is that all residents have no direct access from their suites to the underground parking. You have to take 2 separate elevators to get to your car. At Shangri-La you can just take 1.

3. Low Maintenance Fees. Suites at Shangri-La on the lower floors (below 50) have maintenance fees of only 54 cents per square foot. Ritz fees are more like $1 PSF (same as the estate floor units at Shangri-La). Low maintenance fees usually translate into higher prices per square foot.

4. Smaller units. Shangri-La has many sub-1000 sq ft units. The smallest units at the Ritz are about 1200 sq ft. Smaller units = lower price = more potential buyers = faster sales and higher average price per square foot.

My Advice For Sellers

If you are trying to sell at The Ritz, study the sales history (there is more than a year of it now) and price your unit accordingly. Learn from the lessons of those who have come before you. Don’t try to chase the market, let the market chase you. Contact me for a full report on Ritz Carlton Prices.

If you are selling at Shangri-La, look at the Ritz example as your guide, it will be best to you to sell now, rather than waiting, unless you are willing to wait 1-2 years. The fact of the matter is when there is years worth of inventory in any building or neighbourhood, there will be downward pressure on prices. Expect  a lot of inventory to come online at Shangri-La over the next 6 months, just like we saw in the first 6 months at The Ritz. For more information, please contact me.

My Advice For Buyers

Make sure you visit all 3 buildings before deciding where you want to buy. Go to the restaurants at all three (and be sure to bring me along), sample the service and the flair of each brand and decide which one is best for you and your lifestyle.

The Ritz Carlton continues to be one of the best bargains in Toronto. I think in time we will look back in future years in disbelief at the prices that people are getting these units for when you compare it to everything else in the city. Contact me for complete details on available listings and a free report on Ritz Carlton prices.

Be patient if you decide to buy at Shangri-La. There is no need to jump on anything unless you are getting a great deal as there will be a lot of inventory coming soon in this building and you have a situation where the developer will be competing with individual resellers – exactly what you want as a buyer. Contact me for market updates on available inventory at Shangri-La.

Now Over To You

What do you think? Which tower will be considered the best of these three and why? Will prices at The Ritz start to rise now that they seemed to have leveled out? What will the first units at Shangri-La sell for?