5 Reasons Why There Are Still Bidding Wars in the Toronto Condo Market

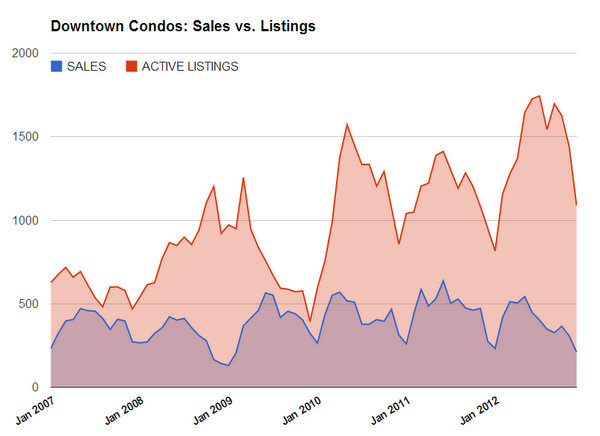

We are definitely in a buyer’s market. The overall sales:listing ratio for December was only 19% for downtown. Well below the 25% threshold to call it a buyer’s market.

For at least the last 6 months, the media has been full of reports of the imminent collapse of the condo market with predictions ranging from price drops of 10-25%. (In actuality prices are flat or in some cases down slightly from last year)

Yet we are still seeing bidding wars pop up across the downtown, even in this bitterly cold January we are currently suffering through. The Star and the Globe both published articles this week talking about the puzzling state of affairs that is the downtown Toronto condo market.

So what’s going on? Why are there still some bidding wars happening when the market is supposed to be dead as a door knob? Let me suggest 5 reasons why this is happening:

1. Supply is dropping

Supply dropped off dramatically in the last 3 months of 2012 (see chart). This was not unexpected. Supply always drops off in the last quarter of the year. The sales:listing ratio has held fairly steady since July at around 20%. We are not in 13-15% territory that we were in during the 2008 recession. As long as supply stays in check in Q1 of 2013, expect some bidding wars to continue to happen, and prices to be relatively flat.

2. Buyers are still active

There are plenty of buyers still out there looking for quality product (which is always in short supply). Listing appointments at my office are up this week from last week, even though we have been experiencing this bitter cold-spell. One listing I recently visited has been on the market for 2 months and yet they have had more than 10 showings in the past week. This is not what we saw in 2008 (the last time condo prices fell). This kind of activity means buyers are out there biding their time until they find the right property then they pounce, which sometimes results in multiple offer scenarios.

3. Mortgage rates are still low

Money is still dirt cheap. A $300,000 mortgage will only cost you about $1400/month, and that’s with a traditional, Flaherty approved, 25 year amortization. A year ago nearly everyone was talking about the fallout that would happen when mortgage rates started to rise in 2012. It never happened and for the remainder of 2013 an interest rate increase north or south of the border is extremely unlikely.

4. Rents are increasing

A studio now rents for about $1400/month downtown. That’s a lot of money and it represents a big increase from just a couple years ago. There is growing fatigue among tenants in the rental market from bidding wars and the tide perhaps is beginning to as renters realize that they are better off buying than renting.

5. Downtown Toronto is booming

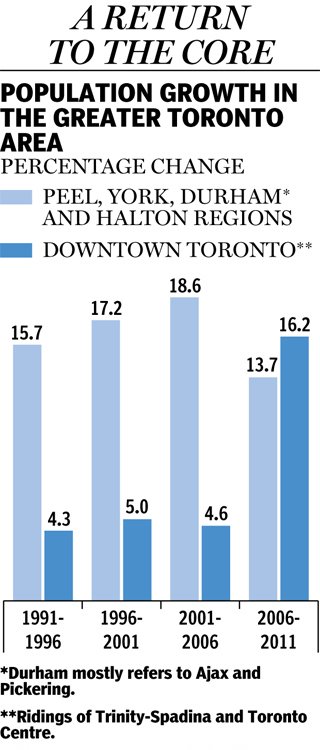

100+ cranes don’t lie. The residential and commercial boom we are undergoing is staggering: people want to live and work downtown and they are willing to pay for it. Turns out that the growth rate of the downtown core is more than triple that of the growth rate of the suburbs from 2006-2011.  Check out the chart above that I swiped from the National Post.

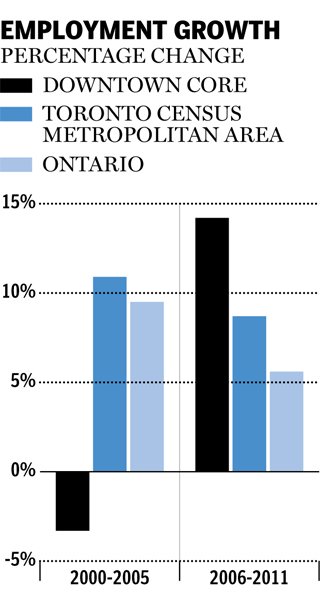

Why are so many people moving downtown? It doesn’t take a rocket scientist to figure out it’s because that’s where the jobs are. Check out this chart showing employment growth. Amazing. Really helps to understand and give a picture of where this city is going over the next 10 years and why I still firmly believe that investing in a downtown condo for the long term is a great investment.

If you like what you are reading, please become a truecondos.com subscriber to get even more great information sent directly to you each week. Drop your name and email in below.