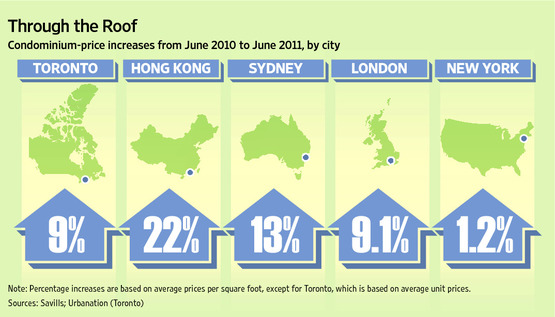

Wall Street Journal Chimes in on the Toronto Condo Market

I guess this makes it official: everyone is talking about the Toronto condo market. I was interviewed a couple weeks ago for an article on our condo market by a writer for the Wall Street Journal, and today that article hit wsj.com. Read the entire article here. See what people on Twitter are saying about the article here.

The article certainly has a bearish slant to it, with the basic thesis being: the market has been booming for so long it therefore must crash. Certainly not something we haven’t heard before many times over the last decade, but should this article give individual investors pause as to whether or not they should be buying a condo in Toronto right now?

I was asked my opinion on the market and the prospects for a ‘correction’. What I told the writer was the same thing I’ve been saying on this blog for a while now: the likelihood for a correction in the short term is very low, the fundamentals right now are strong. However, even the most bullish investor must admit that a key driver to this market has been the lower-than-low interest rates we have had over the last few years. If rates continue to stay low, demand will continue to be strong, prices will continue to rise, and thus, the potential for a correction will grow. In other words, no market can rise at 6-8% per year ad infinitum, but as long as money is cheap, the market will likely keep its momentum.

I would love to hear your comments. Leave one below or email me.

Graphic above taken from the wsj.com article.