Why New Condo Prices Will Not Fall

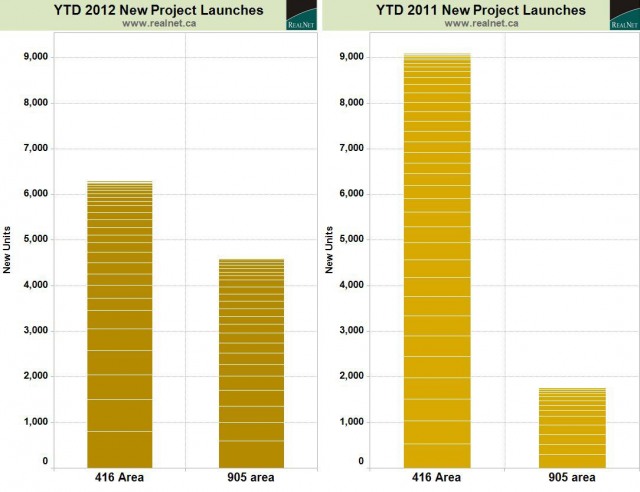

I came across this phenomenal chart from the fine folks at Realnet showing the inventory levels of new housing/condo launches in the GTA. Newly released product so far in 2012 is down 31% in Toronto (416) compared to what was released by developers at this point last year.

This chart reminds me why those who are trying to ‘time’ the market and are waiting for prices to fall will likely be disappointed. Price reductions of any significance are extremely rare in the new condo market. Yes, I am expecting there will be some reductions from some developers in the second half of this year, and yes, we are already starting to see this happening in pockets, but the reality is it takes something shocking and sudden, like the market crash of 2008, for prices to move downwards on a noticeable level.

The reason for this is simply because when developers can see what is happening in the market, when there are no major and sudden triggers, they can control supply levels. If the market is not where they want it to be, they simply don’t release a new building. Supply is tempered, and prices tend to hold steady (as we are seeing for the most part now).

I suspect that the trend we are seeing so far in the 416 market we will also see in the 905 market in the second half of this year. Â So far this year the story has been that the 905 is out-performing the 416, however, I think that will change as we head towards 2013.

The resale market is a totally different animal compared to the new construction market. Stay tuned to this blog in the months to come for analysis of the resale market.

What do you think? Leave a comment or contact me.