9 Things to Know about The Downtown Condo Market

1. Supply is Growing

Supply is at an all time high, even surpassing the mini-market peak of mid-2010. The silver lining on this is that supply is generally highest around June every year and tapers off in the second half of the year. If this happens the market will probably be fine. Will this trend with supply continue is a key question moving forward.

2. Sales Peaked in May

You can see that by historical standards the volume of sales downtown is still quite decent, however, the big thing is that sales decreased in June. Again, May or June are usually the peak months for volume of sales. This year it was May and then sales dipped in June.

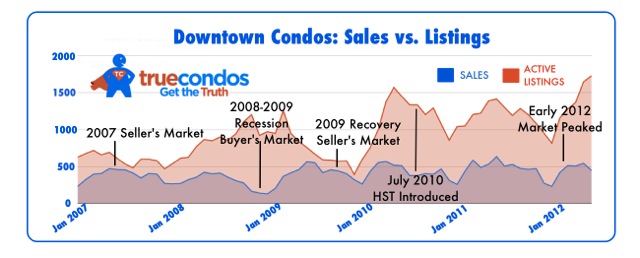

3. Sales Dip + Inventory Up = Buyer’s Market

The combination of rising inventory levels over the last few months with a drop in sales in June resulted in the 26% sales:listing ratio that was the lowest since early 2009. This is why you see a large gap between the red and the blue lines. A growing gap decreases pressure on prices, a shrinking gap increases pressure on prices. Right now the gap appears to be growing.

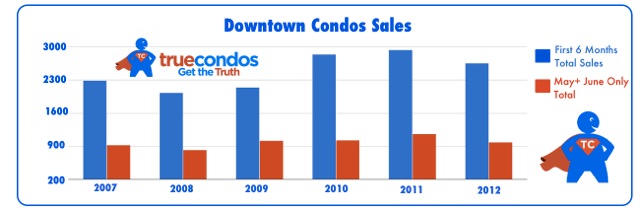

4. The Sky is Not Falling

When you look at the sales for the first six months of the year, you can see that 2012 stacks up quite well against the last six years. We are down from 2010 and 2011, but these were the two best all-time years.

5. The Sky Might Be Falling

When you look at the two most important months of the year, which are May and June (one of them is always the peak month for sales every year), things are not looking as good. 2012 is the first year since 2008 that we have not hit 1000 sales in those months (991 sales for May+June 2012).

6. Prices Holding But Could Fall

So far prices have held up on a year-over-year basis. Will this continue? This depends on how the sales:listing ratio holds up (currently at 26%). If it holds at around 25-30%, then prices will likely not fall but rather just flatten out. If the ratio falls below 20% then prices could fall by as much as 5-10% this year, however the likelihood of this is still low based on the data we have right now.

7. Market is Still Relatively Strong; We are Not in a Crisis Situation

We have become so used to seeing the headline “Toronto Condo Market Sets New Sales Record“. If you only define a strong market as one that breaks the previous sales and price records every single year, then we are not going to have a strong year. If you look at the current market and how it stacks up historically, you can see that we are still in a very active market and there is no crisis or anything dramatic like this going on.

8. Supply is The Key Variable to Watch

Inventory levels should start to fall off as we head into the second half of the year (as they do every year). Sales will fall too. It is rare for the sales:listing ratio to actually increase in the second half of the year, therefore I’m expecting the sales:listing ratio to hold at around the 25% mark which would make it a buyer’s market for the remainder of 2012. If this is the case, and several months of a buyer’s market pass by, prices will likely start to fall.

9. Now is Not The Time to “Cash Out”

A Realtor in Vancouver made headlines last week for saying on his blog that now is the time to cash-out and he apparently did so himself by selling his own property. He is looking at the rising inventory numbers in Vancouver and concludes that the value of properties in Vancouver will soon fall significantly. He may be right, he may be wrong, but when you look at the numbers for the Toronto market there is no reason to believe that prices will fall substantially in the second half of 2012. If history is any indication, sales will decrease over the second half of the year, BUT so will inventory levels, reducing the chances of a significant price correction.

Thanks for reading. If you enjoyed this article and the other article I recently posted on the current market conditions, please take a few seconds and become a subscriber.