2 Reasons Why The Condo Market Is About To Heat Up

It’s no secret that the condo market is relatively slow right now. Sales are down, prices are more or less flat from a year ago, and inventory is at or near all time highs. Many people have been saying for quite some time that a crash in the condo market is imminent.

It’s no secret that the condo market is relatively slow right now. Sales are down, prices are more or less flat from a year ago, and inventory is at or near all time highs. Many people have been saying for quite some time that a crash in the condo market is imminent.

The housing market on the other hand, is just as hot as ever, with prices soaring to new heights as the spring market is underway and houses are once again selling for $50-$100K over the asking price. Prices have increased for many homes by $50K…since November!

So how can this be? How can houses be so hot and condos be so cool? Is the condo market oversupplied? Are we suffering from an “island effect” with respect to housing (no land to build) and this is driving prices up? Are we a city that has an irrational attachment to freehold homes?

The reasons for the divergence between the housing market and the condo market over the past year can be argued, but the bigger question is: will this trend continue? Will we see house prices continue to rise while condo prices fall?

My answer: no. Not a chance.

There are 2 key reasons why I believe the tide is about to turn in the struggling condo market:

1. The gap between house prices in Toronto and condo prices is in all-time high territory.

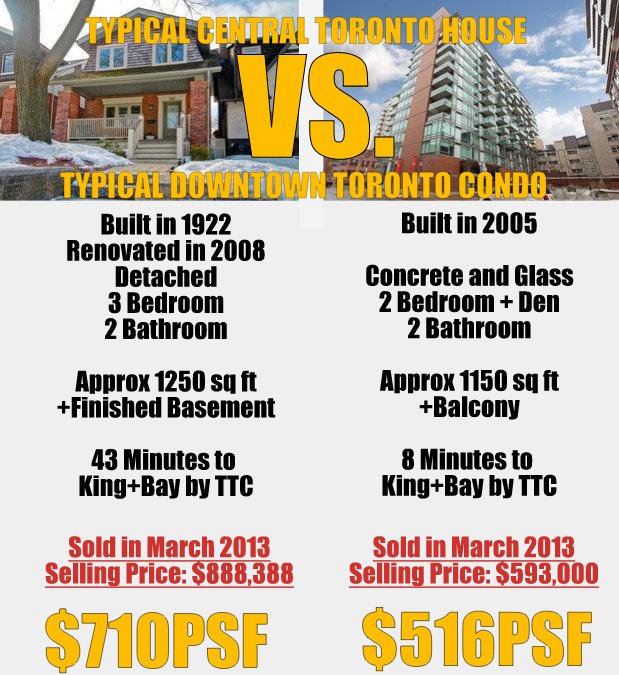

The house above sold in a bloody bidding war at $113K over the asking price. The condo on the other hand sold with a single offer and $6K under the asking price.

Yes, I know it’s not a perfect apples to apples comparison and both condos and houses have their inherent pros and cons as dwelling places but my point is that many people don’t realize you can get a very nice LARGE condo downtown for around $500 per square foot including parking and locker. A renovated house in desirable central Toronto neighbourhood can easily push you past $700 per square foot.

Is it really worth the extra $200 per square foot just to be able to say you are a ‘home owner’?

2. The gap between renting a condo and owning a condo is in all-time low territory

The combination of 1) soaring rents, 2) falling interest rates and 3) flat or slightly lower prices means ownership is once again starting to look more appealing than renting – especially for smaller condos under $350K.

1 bedroom+den condos are now routinely being rented for $2000/month, 1 bedrooms for $1700, studios for $1400. Long term renters who have significant down payments saved up (15-20%) will at some point really have to think twice about renewing their leases rather than just going out and buying something of their own.

The red hot housing market clearly shows that the buyers are out there in Toronto, they have lots of money and they want to own real estate. This truth, combined with the two factors above  lead me to believe that the pendulum will swing back soon in the condo market. At some point buyers will start acting more rationally and realize that the condo market offers tremendous value right now.

3 Quick Implications

1. For House Buyers. Get ready for another rough spring. Bidding wars are happening on just about every property. The mentality is once again ‘buy now or forever be priced out’. Ask yourself if it’s worth paying massive premiums to own a house when you can live in a condo downtown for much less.

2. For Condo Buyers. Get out there and buy something! I don’t know when the condo market will start to heat up again but I suspect as soon as the weather does, it will too. Right now there are plenty of desperate sellers waiting for your offer, if inventory shrinks up in the next couple months so will the opportunities.

3. For Investors. If you only have ever invested in freeholds, consider adding a condo to your portfolio this year. There are really some great deals out there in the condo market and rental rates are at record highs. Positive cash flow with 20% down is very attainable.